With his final annual letter to Berkshire Hathaway investors, Warren Buffett has effectively written the last chapter of a six‑decade investing saga.

Berkshire’s leadership is passing to Greg Abel as Buffett steps back at the remarkably young‑at‑heart age of 95.

Abel inherits not just a portfolio, but a philosophy of disciplined capital allocation, conservative balance sheets, and a relentless focus on intrinsic value. The real question for investors is not whether Abel can be another Buffett, but whether Buffett’s playbook can outlast the man who wrote it.

Buffett’s edge lasted across various eras because his focus was not on speed or exotic tools, but on patience, clarity, and a refusal to mistake volatility for risk. That mindset is still available to anyone willing to slow down and think in decades instead of days.

Buffett’s Unmatched Track Record

Buffett’s tenure produced extraordinary returns: roughly over 6,000,000% total appreciation for Berkshire Hathaway’s Class A shares from 1965 through the end of 2025. That works out to a compounded annual gain of roughly 19–20% for Berkshire versus about 10% for the S&P 500 — almost double the market’s annual return, sustained over six decades.

Those numbers are hard to imagine (and even harder to replicate), which is why the mindset behind them matters more than the math.

At a time when AI, algorithms, and noise dominate markets, Buffett’s true legacy isn’t his returns; it’s a playbook for thinking about risk, volatility, and human potential in an age of AI and uncertainty.

To understand how that philosophy shows up in practice, look at Berkshire’s positioning in 2025.

Berkshire Hathaway’s 2025

2025 drove home just how conservative Berkshire remains — and how consistently that conservatism has paid off.

The company built over $350B in cash reserves, sold significant amounts of its Apple stock, increased its ownership in Japanese trading firms, and maintained its financial strength amid volatile market shifts.

They held on to many of their core holdings (such as Coca-Cola and American Express) and still saw portfolio value growth despite the move toward cash. They’re one of the few businesses I can say I’m not surprised beat the market (again).

Those decisions reflect themes Buffett underscored in his final annual letter.

Lessons From His Final Letter

”Greatness does not come about through accumulating great amounts of money, great amounts of publicity or great power in government. When you help someone in any of thousands of ways, you help the world. Kindness is costless but also priceless. Whether you are religious or not, it’s hard to beat The Golden Rule as a guide to behavior.”

It’s inspiring when a successful leader focuses on making things better for others, rather than simply winning. Perhaps that’s actually a healthy redefinition of what “winning” means.

Readers of past letters will recognize familiar themes, now paired with a more reflective look back at an incredible career.

In many ways, it reads as a love letter not only to America but also to humanity.

He comes off as humble and down-to-earth … yet also proud of his achievements.

Key takeaways?

- Take a long-term perspective … stock price volatility (even large drops) is a normal and expected part of markets and should not derail long-term investing.

- Acknowledge the role of luck … even when you’re as disciplined and effective as Buffett, luck always plays a role.

- Don’t beat yourself up over mistakes … acknowledge them, learn from them, and do better.

Berkshire’s 2025 decisions are simply the latest expression of habits Buffett has honed over a lifetime.

A Look Back At Buffett’s Career

Warren Buffett is a legend for many reasons. Foremost among them might be that he’s one of the few investors who clearly has an edge … and has for a long time.

Buffett didn’t chase lottery tickets; he stacked small, repeatable wins, and let compounding do the heavy lifting. There’s power in that. He also noted that as stock trading has become more accessible – it’s made daily buying and selling easier, but also more erratic. That, unfortunately, benefits the “house” more than individuals.

While most people label Buffett an investor, his story makes even more sense if you think of him as a scrappy entrepreneur.

At the age of six, he started selling gum door-to-door.

He made his first million at age 30 (in 1960). For context, a million dollars in 1960 would be worth about $10.4 million today.

Buffett has always been honest about his bread-and-butter “trick”… he buys quality companies at a discount and holds on to them.

Sixty‑five years later, it is striking how dramatically the world has changed — and how little Buffett’s core playbook needed to.

The Lesson Behind The Lesson

Seeing Warren as an entrepreneur, rather than just as an investor, turns his ideas into axioms for life and business, not just trading.

Money will always flow toward opportunity, and there is an abundance of that in America. Commentators today often talk of “great uncertainty.” … No matter how serene today may be, tomorrow is always uncertain.

Don’t let that reality spook you. Throughout my lifetime, politicians and pundits have constantly moaned about terrifying problems facing America. Yet our citizens now live an astonishing six times better than when I was born. The prophets of doom have overlooked the all-important factor that is certain: Human potential is far from exhausted, and the American system for unleashing that potential – a system that has worked wonders for over two centuries despite frequent interruptions for recessions and even a Civil War – remains alive and effective.

We are not natively smarter than we were when our country was founded nor do we work harder. But look around you and see a world beyond the dreams of any colonial citizen. Now, as in 1776, 1861, 1932 and 1941, America’s best days lie ahead

This excerpt from his 2011 letter doesn’t just speak to America’s longevity; it speaks to our own capacity to keep reinventing ourselves.

Few forces hold people back more than an outsized fear of failure.

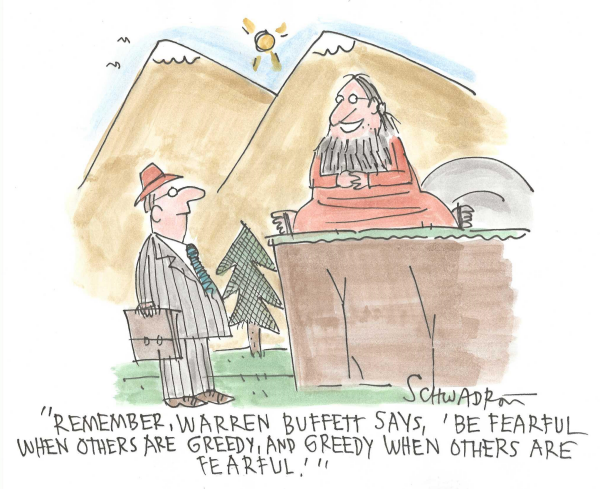

Fear, uncertainty, and greed are hallmarks of every year. The world will continuously cycle through ebbs and flows, but the long arc still bends toward greater possibility and greener pastures.

What This Means For Us

Not every investor can (or should) copy Buffett, but everyone can borrow his mindset around patience, risk, and human potential.

If you let yourself be persistently frightened into believing that the world is doomed, you’ll never take the risks that could change your life for the better. Worse still, if you never experience failure, you’ll never learn to get back up, brush yourself off, and grow stronger for future success.

The game is not about the next year or even three; it is about a lifetime, and the generations that follow.

Buffett’s run may be ending, but the forces he trusted — human ingenuity, compounding, and long‑term thinking — are even more important.

In an AI‑driven world, the edge won’t belong to whoever has the most models; it will belong to those who stay patient, take intelligent risks, and keep betting on human potential — starting with their own.

Let’s continue to make our tomorrows bigger and better than our today.

Onwards!

Leave a Reply