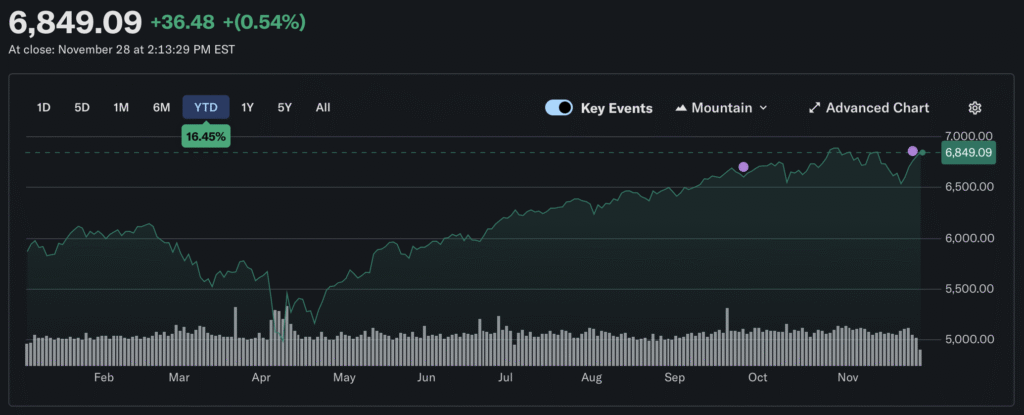

If you’ve been watching markets lately, you’ve probably felt both fear and greed as we push toward uneasy highs. Last week, staring at a chart of the S&P 500, so did I.

The S&P 500 Index was up double digits again this year– incredible! Yet I keep hearing fear, uncertainty, and doubt around me. Many are still optimistic … but most are frustrated. So, on one level, it’s just another normal year in markets.

But what if it isn’t?

Does the current performance of the S&P 500 Index really represent what’s happening in America’s leading companies?

via Yahoo! Finance

The Story Behind The Headline

The S&P 500 Index is intended to represent the top 500 large companies on the U.S. Stock Exchange.

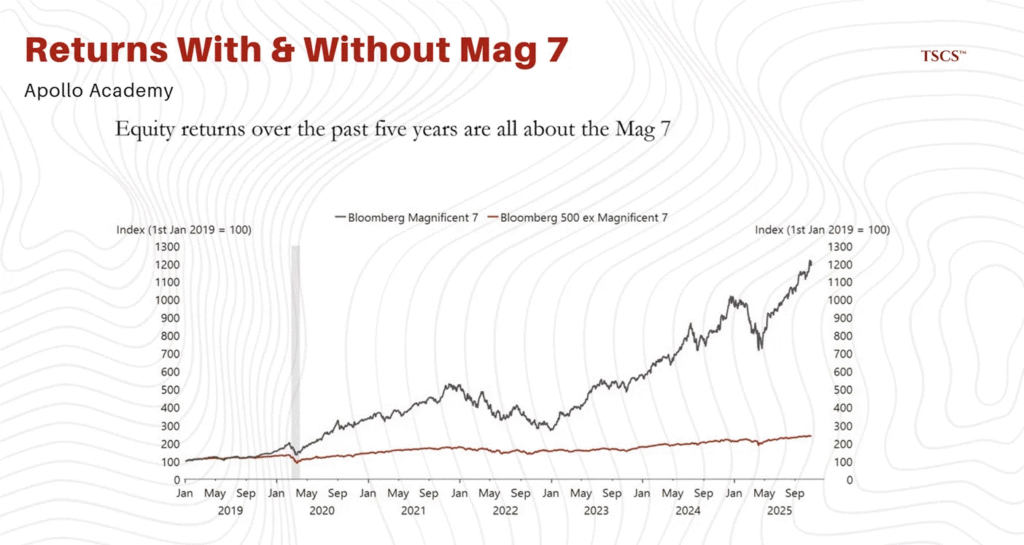

Today, seven enormous firms (Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla) account for about one-third of the index’s total value. Their success is real, and much of it is fueled by the AI boom. But when a few companies get that big, they don’t just show up on the chart … they bend the chart around them.

That’s why the “S&P 500” is really two markets:

- The Magnificent Seven, riding a tidal wave of AI-driven demand,

- And the S&P 493, filled with companies facing higher costs, tighter credit, slower demand, and more pressure.

Why You Care

If you lead a company or allocate capital, you know a simple truth:

Signals shape decisions — but only if you trust the signal.

The problem today is that the most visible signal (the headline index) is being lifted by a narrow slice of the economy. And when that happens, we risk misreading:

- The true economic climate

- The real risks beneath the surface

- The strengths and weaknesses that will matter over the next cycle

When the map and the terrain aren’t aligned… It’s worth asking why. So let’s explore what the S&P 493 is quietly telling us.

Spoiler Alert: It’s telling us to be excited about AI.

ChatGPT launched three years ago. Since early 2023, Nvidia has surged more than 1,000%, including a 29% gain this year alone. Micron is up about 130% year-to-date, while Palantir has doubled over the same period. Vertiv has climbed roughly 35%, driven mainly by demand for data-center cooling, and even Intel (despite announcing major layoffs) has risen around 70%.

AI is the new “picks and shovels” trade. Infrastructure is hot. Compute is oxygen. And the biggest firms with the deepest moats are attracting a disproportionate share of investment and attention.

This post isn’t claiming that the market is wrong. Instead, it suggests that the market is telling us where the opportunities and dangers concentrate.

The Main Street Struggle

Step outside the Magnificent Seven, and you see something very different.

- A third of small-cap stocks are unprofitable.

- Many are getting squeezed by higher interest rates.

- Tariffs and supply-chain frictions hit smaller firms first.

- Capital spending outside AI is flat.

- Small caps (e.g., the Russell 2000) look even more stressed: many are unprofitable, more leveraged, more exposed to tariffs, and more sensitive to interest rates.

Please note that the “S&P 493” contains strong, durable businesses; this post is not trying to overgeneralize that everything outside the Magnificent Seven is broken. With that said, small companies are the canaries in the economic coal mine. So it pays to pay attention to them, too.

For example, when the Fed hinted at “further adjustments,” small caps jumped 2.8% in a single day because the move was driven by relief at the prospect of easier policy, not by improving fundamentals — a sign of fragility rather than confidence.

So how do we reconcile booming giants with struggling small firms?

Concentration as a Systemic Risk

When seven firms drive the index, you don’t just get skewed headlines. You get a hyper-sensitive economy and a single-point-of-failure scenario not-so-hidden in plain sight. Not to mention, a gravitational pull that draws resources, talent, and eyes towards them and away from the average business.

That gap between giants and everyone else isn’t just a curiosity — it’s changing how the whole system behaves.

Are the Magnificent Seven-type companies Apex predators monopolizing an ecosystem? Not yet. Is it a potential future if nothing changes? Absolutely. This is where intentionality matters, and where leaders need frameworks and decisive actions.

A few concepts I really like in situations like this are:

- Signal Vs. Noise – a lot of information comes across your feed … which of it is actually moving the needle?

- Power Law Thinking – not all companies, markets, or ideas are equal. A few drive most of the alpha. Your job is to identify the drivers, not just the momentum.

- Barbell Strategies – Make safety your bread and butter, but leave attention and capital ready for high-risk, high-reward opportunities. Allows you to play the game (and bet on a bigger future) without losing your shirt.

For example, as you try to stay ahead of the curve and sift the signal from the market noise, you can try looking at small-cap health as an early‑warning indicator. Also, look at interest coverage ratios, AI spending vs. AI Profits, and supply-chain lead times.

These are examples of underlying drivers that go beyond simply looking at a stock market chart.

Closing Thoughts

Ten years from now, I suspect we’ll see a few things clearly:

- Diversification wasn’t what people thought it was.

- AI winners (chips, compute, data) will look different from AI users.

- Small firms will remain the early-warning system for economic stress.

- And the companies — and leaders — who thrive will be the ones who learned to read the real signals, not just the loud ones.

Markets always leave tracks … but not always where people expect.

The future belongs to leaders who don’t chase noise, but who understand nuance … and who can see the quiet signal inside the uproar.

Remember, volatility is not the enemy; fragility is.

So here’s the question I find myself asking — and one I encourage you to wrestle with too:

What part of your strategy depends on the strength of giants? And what part depends on your own ability to adapt, innovate, and stay resilient?

I’d love to hear what you think. Let me know.

Onwards!

Leave a Reply