A few months ago, I wrote about how cryptocurrency was entering the mainstream.

To recap that piece: I’ve historically been skeptical and resistant about crypto on several fronts. Still, I’ve recognized that blockchain and decentralized finance are here to stay.

One of my biggest arguments against crypto is that governments have fiercely protected their right to print money and tax it. Now, even governments are warming up to crypto. Additionally, regulators are getting on board. Big banks and established industries are creating infrastructure. As the momentum builds, the push toward crypto seems unavoidable.

New giants were — and are —forming. Coinbase recently joined the S&P 500. Circle just had a wildly successful IPO. The performance of stocks like these also hints at a growing market appetite for crypto-focused businesses.

Some of this momentum has been fueled by policy shifts during the Trump presidency and his administration’s openness to the space. Yet even with that tailwind, I believe there are still significant barriers to the adoption of most cryptocurrencies—barriers that stablecoins, in particular, are designed to address.

The Stablecoin Surge

Since that article, tremendous growth continues. And if you haven’t paid attention to stablecoins yet, it’s time to start paying attention.

What is a Stablecoin?

Stablecoins are cryptocurrencies designed to maintain a stable value, typically pegged to a traditional currency like the US dollar (e.g., 1 stablecoin = $1 USD). Unlike Bitcoin or Ethereum, which can swing wildly in price, stablecoins aim for predictability.

Think of stablecoins as the digital equivalent of cash — useful for transactions, storing value, and moving money across borders without the volatility of traditional cryptocurrencies.

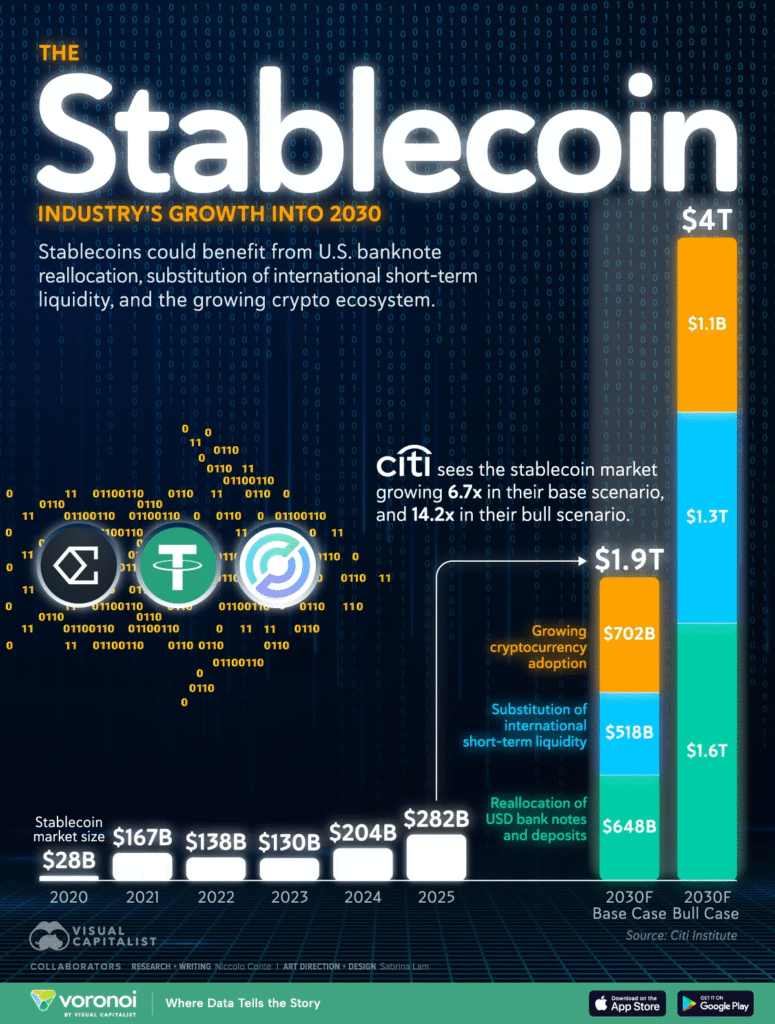

via visualcapitalist

The stablecoin market has seen a 10X increase in just five years. In fact, their transfer volume is now more than both Visa and Mastercard.

They’ve quickly grown from a niche asset to one of the fastest-growing market segments.

Citi projects that the market will grow 6.7X to 14.2X in the next 5 years. Their justification is based on three main pillars.

- the reallocation of US cash and deposits into digital tokens,

- the substitution of international short-term liquidity tools with stablecoins,

- and the growing role of stablecoins as the backbone of cryptocurrency adoption (in a growing ecosystem)

It’s also worth noting that stablecoins have become a kind of “parking spot” for capital moving in and out of crypto trades. As smart contracts have enabled holders to earn yield by lending, providing liquidity, or farming rewards, stablecoins’ appeal has only grown.

A Glimpse of Crypto’s Future

It’s easy to imagine a future of money built on digital tokens. Stablecoins appear to be the first step toward that future.

Just like everything else … it’s happening faster than you think.

A few weeks ago, we took a look at the state of the US dollar.

This week, visualcapitalist released a graphic looking the value of stablecoins in relation to US cash in circulation.

via visualcapitalist

Comparing the market value of stablecoins to the amount of U.S. currency in circulation (bills and coins) shows that stablecoins now make up about 11% of that total. That’s a remarkable jump in just five years.

The industry keeps innovating, and stablecoins are increasingly becoming part of traditional finance. I expect this trend to grow faster soon.

What’s your opinion on how quickly stablecoins might transform the monetary landscape?

Leave a Reply