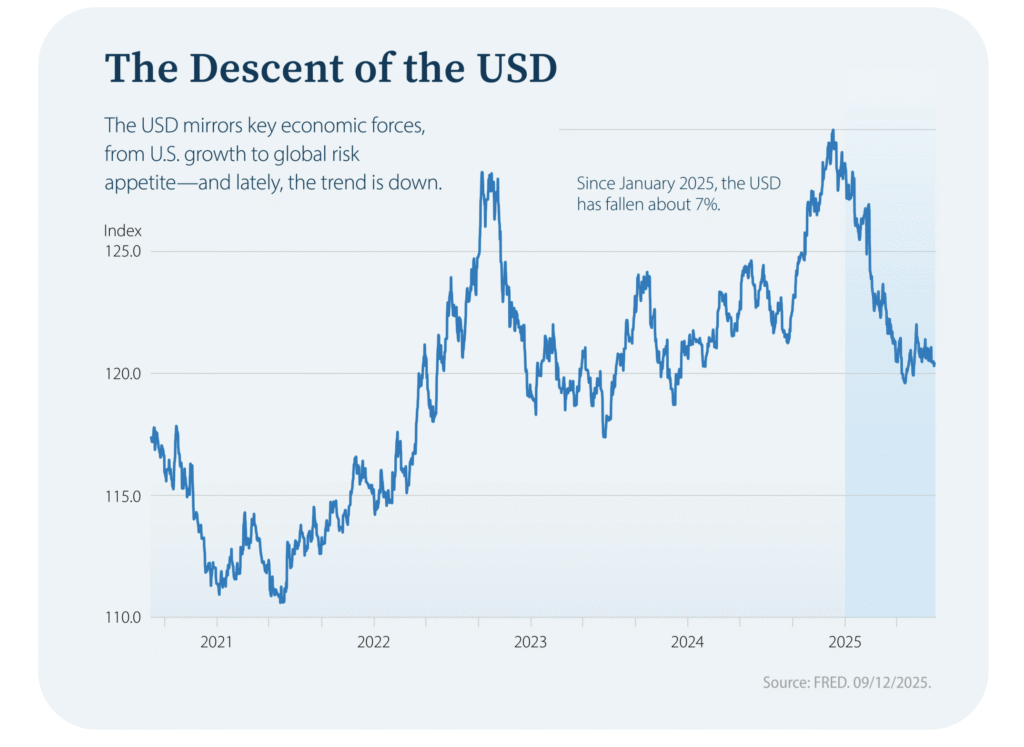

In 2025, the U.S. Dollar has experienced its biggest decline in over twenty years. A drop of more than 10% in a primary global currency is always significant — and this decrease is sending shockwaves through markets, policy discussions, and consumers’ budgets. But what’s truly driving this change, and what does it mean for you?

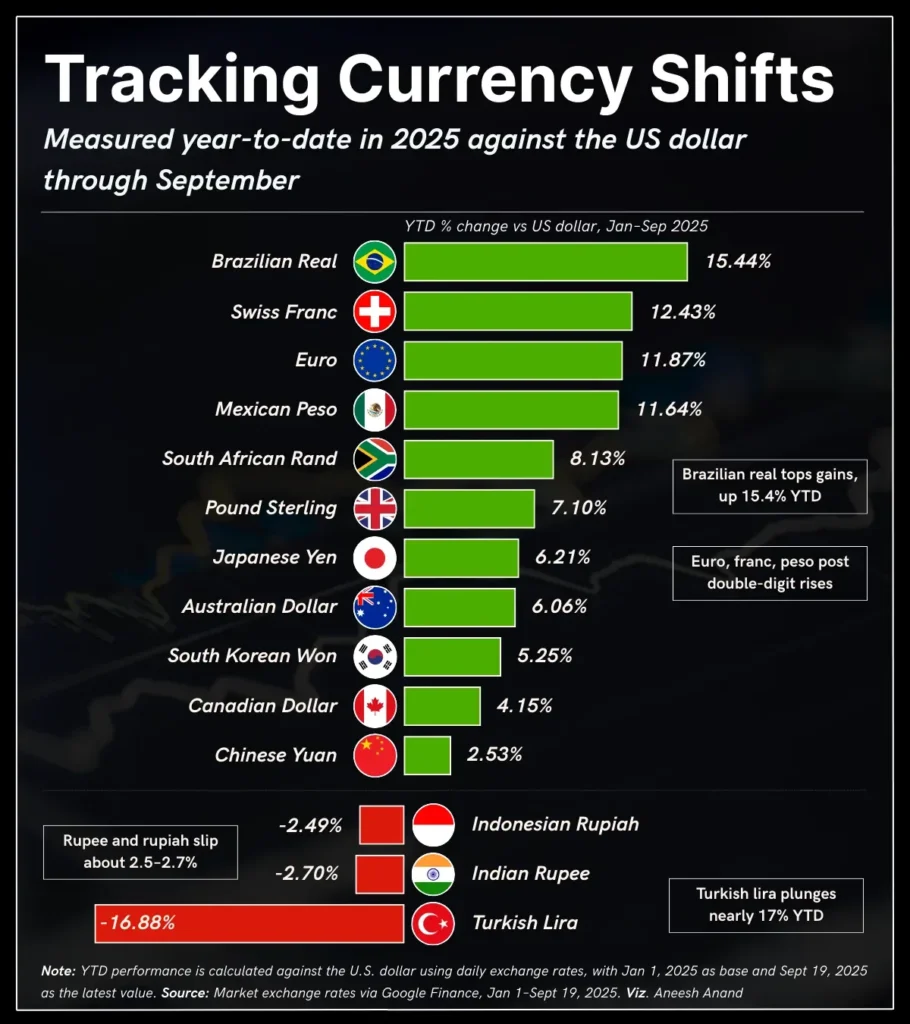

While substantial, the Dollar’s decline is just one of several significant moves among major currencies. For a broader perspective, here is a chart highlighting key global currency trends this year.

via voronoi

The Brazilian Real is up 15.4% YTD, while the Swiss Franc, the Euro, and the Mexican Peso have each gained more than 10% this year.

Nevertheless, the U.S. Dollar continues to assert its dominance as the world’s primary reserve currency, a status it has maintained since the 1944 Bretton Woods Agreement. This means it is the main currency held by central banks to support international transactions and reduce exchange rate risk. Additionally, it remains the global benchmark against which other currencies are measured.

So, why is the U.S. Dollar down, and why does it matter?

View Full Image via visualcapitalist

A strong currency benefits consumers by making imports more affordable and helping to keep inflation under control. A weaker currency, on the other hand, can be a tailwind for exporters by lowering the global price of their goods, but it also drives up import costs and can stoke inflationary pressures.

The Dollar’s movement reflects not only U.S. conditions but also global ones. As the world’s reserve currency, it responds more directly to worldwide economic forces than most others. This year, soft U.S. GDP projections, high inflation, and the Fed’s shift toward lower interest rates have all contributed to downward pressure on the dollar. But that’s not the whole story.

Of course, no single factor explains the market. The Dollar’s decline isn’t a death knell, just as a surge wouldn’t be proof of perfect health. It’s one signal among many in a complex economic picture.

When discussing negative indicators, it’s just as important to highlight the positive ones — including America’s historical resiliency. While headlines often focus on the dollar’s decline, history shows it has weathered many challenges and thus remains the world’s dominant reserve currency.

For investors and consumers, the lesson is: stay informed, understand the broader economic context, and avoid overreacting to short-term swings. Currency markets move in cycles, and the dollar’s influence won’t disappear overnight.

‘Intentional patience’ often outperforms impulsive action, in trading and in business. By tracking market trends, understanding the underlying factors, and recognizing how currency shifts impact trade, prices, and investments, you can respond strategically rather than reactively to the news cycle.

Leave a Reply