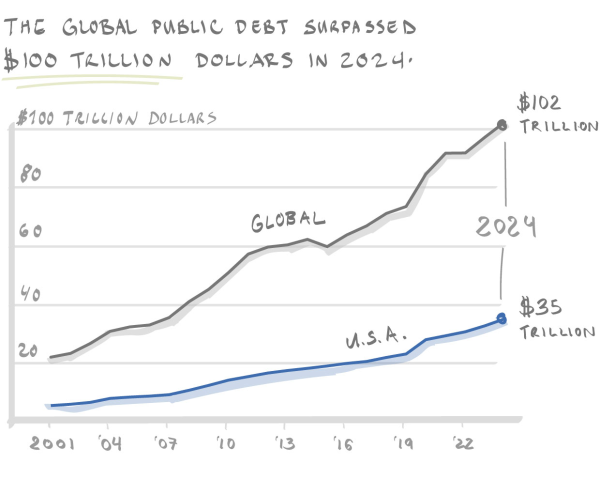

The world is swimming in debt … well, to be more specific … the world's governments are swimming in debt — $100 Trillion of it.

via Barrons

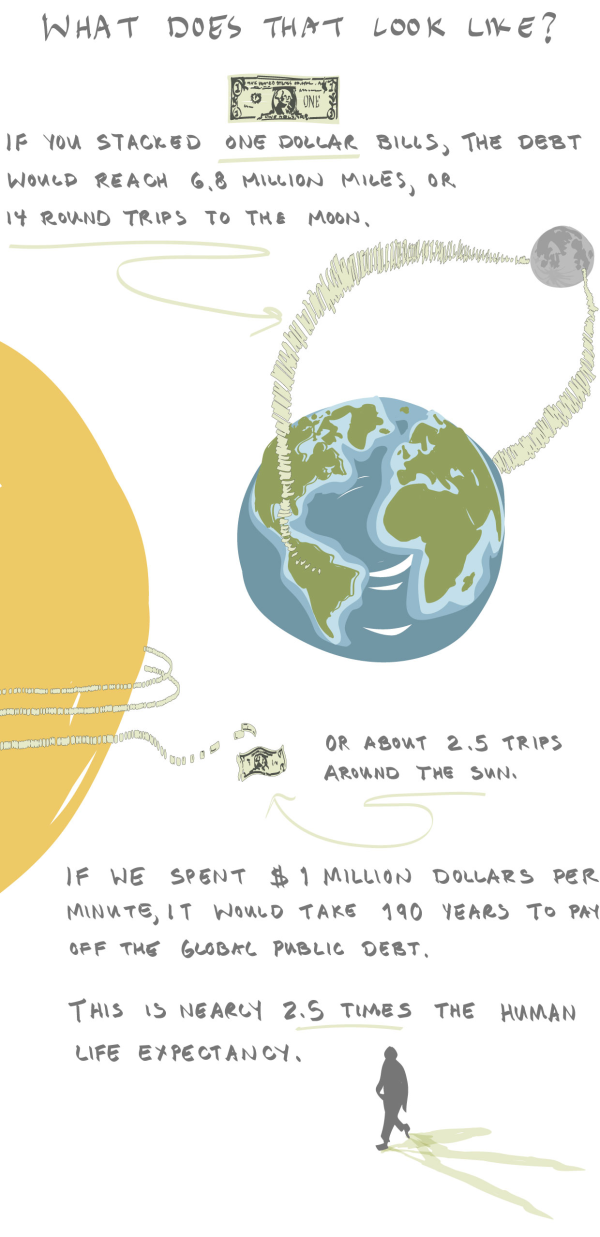

To put that in perspective, here's an illustration to give you a sense of the enormity of that number.

via Barrons

The U.S. accounts for just over 34% of that number. Meanwhile, I remember writing about the Republican National Convention marking the moment our national debt crossed the $16 Trillion level in 2012.

To put the current number in context, if our national debt were divided among individuals, we'd each owe more than $100K … and if the ten wealthiest people donated their entire fortunes, we'd only have covered about 5%.

The concept of "Debt" can be confusing to a layman. Most people understand what it means when they take on debt with a local bank, but it can be harder to understand the role debt plays in global economics.

Compounding the confusion, the implications of debt change on a macro level.

Many worry that our "excessive" government debt levels impact economic stability, the strength of our currency, and unemployment. The national debt can only be reduced through five mechanisms: increased taxation, reduced spending, debt restructuring, monetization of the debt, or default.

The idea behind our current global debt structure is that if two nations are mutually obligated and dependent on each other, they are less likely to go to war. And that has held relatively true so far. Of course, it's not a perfect system (and it could break down), but it's working better than previous systems (such as the balance of power).

In some ways, it's fake money, so our debts don't seem insurmountable or fatal. Our economy is so reliable that we're allowed to continue borrowing. Debt is an integral part of the economic machine – it can be argued that we wouldn't have money without debt.

Ray Dalio created a simple (but not simplistic) and relatively easy-to-follow 30-minute animated video that answers the question, "How does the economy really work?" Click to watch.

via Ray Dalio

The global economy has grown enormously during the last 50 years as developing nations prosper. The average global GDP per capita has gone from ~$1000 to over $10,000 in my lifetime.

So, it makes sense that the amount of debt is also increasing with the size of the money supply required to conduct all the transactions in the global economy.

But, even though you may not need to be immediately worried about that number, I still think it's worth trying to put it in context.

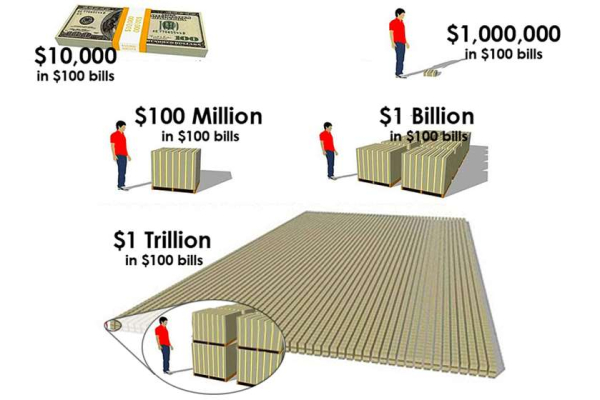

Humans are notoriously bad at large numbers. It's hard to wrap our minds around something of that scale. We're wired to think locally and linearly, not exponentially (it's one of the reasons I love AI so much). Here are a couple of ways to help you understand a trillion dollars.

via AskOpinion

via AskOpinion

First, let's look at spending over time. If you were to spend a dollar every second for an entire day, you would spend $86,400 per day. If you have a million dollars, you can do that for approximately twelve days. With a billion dollars, you can do that for over 31 years. With a trillion dollars, you can do that for 31,000+ years. That means it would take over 300 thousand years to spend the global public debt at that rate.

I'm sure many of you make over six figures a year. But, it would still take you 10 million years – if you spent none of it – to make $1 trillion, let alone $100 trillion.

Let's try explaining it through time. Fifty thousand seconds is just under 14 hours. A million seconds was 11 days ago. A billion seconds ago from today? 1992. One trillion seconds is slightly over 31,688 years. That would have been around 29,679 B.C., which is roughly 24,000 years before the earliest civilizations began to take shape. Pretty crazy.

Here's a video from the 1970s that helps you understand scale through the power of tens and an exploration of our universe.

Eames Office via BetterExplained

Hopefully, that was disturbing and helpful!

Leave a Reply