"Fate has ordained that the men who went to the moon to explore in peace will stay on the moon to rest in peace." – Nixon's Apollo 11 Disaster Speech

In an ideal world, history would be objective; facts about what happened, unencumbered by the bias of society, or the victor, the narrator, etc.

I think it's apparent, that history as we know it is subjective. The narrative shifts to support the needs of the society that's reporting it.

The Cold War is a great example where during the war, immediately after the war, and today, the interpretation of the causes and events has all changed.

But while that's one example, to a certain degree, we can see it everywhere. We can even see it in the way events are reported today. News stations color the story based on whether they're red or blue, and the internet is quick to jump on a bandwagon even if the information is hearsay.

Now, what happens when you can literally rewrite history?

“Every record has been destroyed or falsified, every book rewritten, every picture has been repainted, every statue and street building has been renamed, every date has been altered. And the process is continuing day by day and minute by minute. History has stopped.“ – Orwell, 1984

That's one of the potential risks of deepfake technology. As it gets better, it becomes easier to create "supporting evidence" for whatever narrative a government or other entity is trying to make real.

On July 20th, 1969 Neil Armstrong and Buzz Aldrin landed safely on the moon. They then returned to Earth safely as well.

MIT recently created a deepfake of a speech Nixon's speechwriter William Safire wrote during the Apollo 11 mission in case of disaster. The whole video is worth a watch, but the speech starts around the 4:20 mark.

MIT via In Event Of Moon Disaster

Media disinformation is more dangerous than ever. Alternative history can only be called that when it's discernible from the truth, and unfortunately, we're prone to look for information that already fits our biases.

As deepfakes get better, we'll also get better at detecting them, but it's a cat and mouse game with no end in sight. In Signalling theory, it's the idea that signallers evolve to become better at manipulating receivers, while receivers evolve to become more resistant to manipulation. We're seeing the same thing in trading with algorithms.

I'm excited about the possibilities of technology, and I believe they're predominantly good. But, as always, in search of the good, we have to acknowledge and be prepared for the bad.

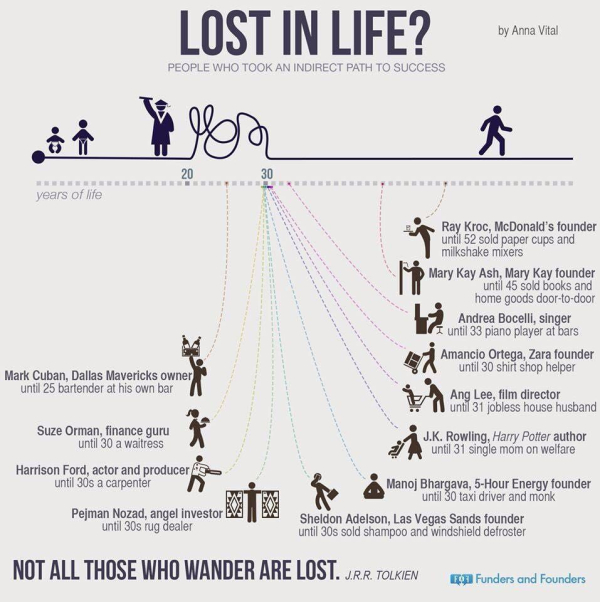

Anna Vital via

Anna Vital via

via

via