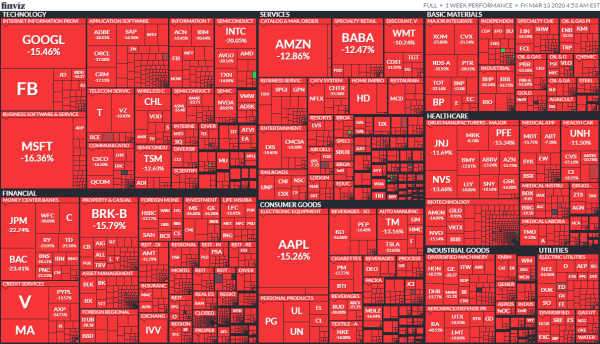

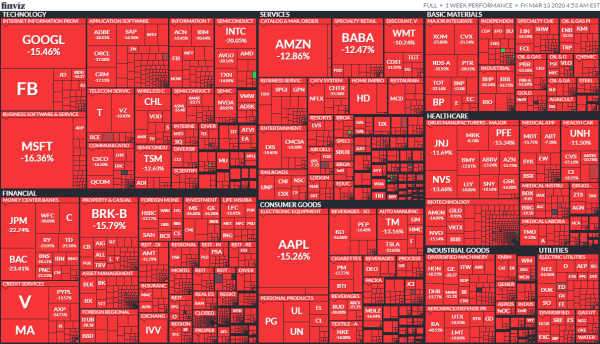

The last few weeks have been pretty volatile in the Markets. We've seen major indices rising and falling 10% in a single day – multiple times. You can attribute some of the selling to fear surrounding COVID-19 (colloquially the Coronavirus) and some of the selling is the result of traders being forced to cover margin calls. Whatever the reason, it has been unsettling …

via FinViz

via FinViz

The NYSE halted trading twice this week. For context, the last time a trading halt like that was triggered was back on October 27, 1997.

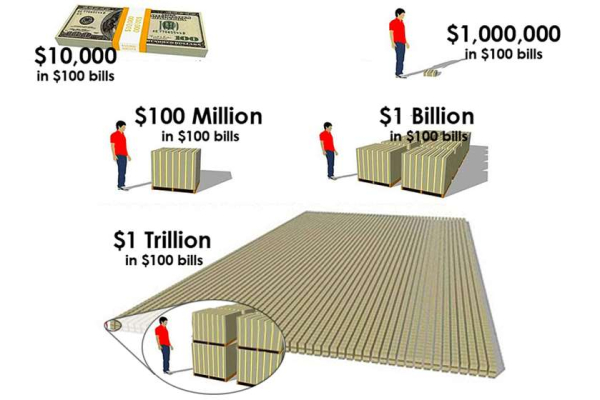

Adding to the agitation, Russia and OPEC are in a price war on oil, and the US both cut interest rates and is pumping $1.5 Trillion of liquidity into our financial system to try and cushion the fallout. While that seems calming, people are worried about why they felt compelled to calm so grandly in the first place.

There are lots of fringe symptoms sprouting up (and making people wonder how bad the root cause really must be). The NBA put its season on hold, March Madness was canceled, Tom Hanks and Rita Wilson caught "The 'Rona," and Trump just announced that the U.S. is closing travel from Europe.

Hospitality, travel, entertainment, manufacturing, small businesses, and a cavalcade of other industries are suffering. Ask yourself, is this it … or is there worse yet to come?

With markets making new lows and volatility shaking out investors in both directions, I thought this would be a good time to talk about coping with losses and how to manage your anxieties in "scary times."

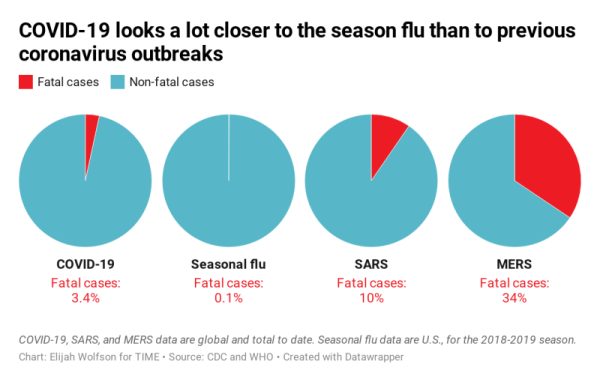

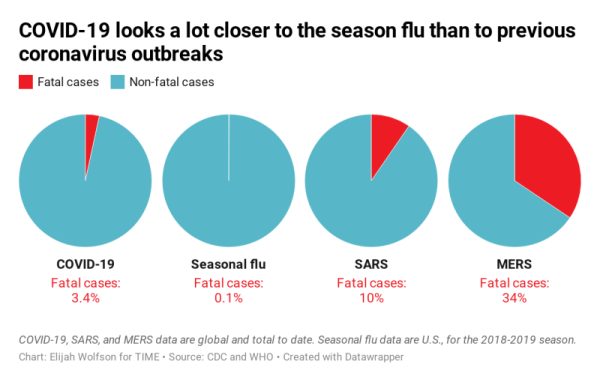

But first, I want to set the frame by reiterating that I believe the fears of the Coronavirus are overemphasized.

Don't get me wrong, COVID-19 is very contagious and the incubation period is 2 weeks, so you have the possibility of getting people sick before you know it. But, the mortality rate is relatively low at 3% (according to WHO as of March 3rd). That means many people will get sick but most people will survive.

To protect yourself from the virus, wash your hands aggressively, avoid touching your face, and avoid communal spaces/items. You don't, however, need to stock up on toilet paper like the world is ending.

via TIME

via TIME

On a systematic level, we need a better response. More testing, more access to treatment, more social distancing. If at the macro level we respond appropriately – and flatten the infection curve – most people have nothing to worry about.

Slowing the spread and increasing the availability of testing (even if the same amount of people get sick) reduces strain on the healthcare system and will save lives.

Now, on to the real point I want to make …

The Anxiety Antidote

"When the trough gets smaller … the pigs get meaner." - Dan Sullivan

Many people are suffering from "I should have …", or "if I would have …", or "if I could have …" thoughts.

The problem is that thoughts like those create more stress and distraction. They are a lens focused on loss, difficulties, past events, things that are missing, and what you don't want.

Think of them as an unhealthy reflex that wastes energy, confidence and time.

All We Have To Fear Is Fear Itself

I often talk about market psychology and human nature. The reason is that markets are a reflection of the collective fear and greed of its participants… people tend to get paralyzed during scary times like these.

But it's not the economy that makes people feel paralyzed. People feel paralyzed because of their reactions and their beliefs about the economy. Your perception becomes your reality.

A little examination reveals that most fear is based on a "general" trigger rather than a "specific" trigger. In other words, people are afraid of all the things that could happen and are paralyzed by the sheer scope of possibilities. These things don't even have to be probabilities in order to scare them.

You gain a competitive advantage as soon as you recognize that it's not logical. Why? Because as soon as you distinguish that fear as not necessarily "true", you can refocus your insights and energy on moving forward. You can act instead of react. You make better decisions when you come from a place of calm instead of fear… so create that calm.

Even a tough environment, like this, presents you with opportunities if you watch for them … or even better, if you create them.

The Scary Times Success Manual

The goal is to move forward and feel better. Strategic Coach offers ten strategies for transforming negativity and unpredictability into opportunities for growth, progress, and achievement. They call it the "Scary Times Success Manual", and what follows are some excerpts:

Forget about your difficulties, focus on your progress.

Because of some changes, things may not be as easy as they once were. New difficulties can either defeat you or reveal new strengths. Your body's muscles always get stronger from working against resistance. The same is true for the "muscles" in your mind, your spirit, and your character. Treat this whole period of challenge as a time when you can make your greatest progress as a human being.

Forget about events, focus on your responses.

When things are going well, many people think they are actually in control of events. That's why they feel so defeated and depressed when things turn bad. They think they've lost some fundamental ability. The most consistently successful people in the world know they can't control events – but continually work toward greater control over their creative responses to events. Any period when things are uncertain is an excellent time to focus all of your attention and energies on being creatively responsive to all of the unpredictable events that lie ahead.

Forget about what's missing, focus on what's available.

When things change for the worse, many desirable resources are inevitably missing – including information, knowledge, tools, systems, personnel, and capabilities. These deficiencies can paralyze many people, who believe they can't make decisions and take action. A strategic response is to take advantage of every resource that is immediately available in order to achieve as many small results and make as much daily progress as possible. Work with every resource and opportunity at hand, and your confidence will continually grow.

Forget about your complaints, focus on your gratitude.

When times get tough, everyone has to make a fundamental decision: to complain or to be grateful. In an environment where negative sentiment is rampant, the consequences of this decision are much greater. Complaining only attracts negative thoughts and people. Gratitude, on the other hand, creates the opportunity for the best thinking, actions, and results to emerge. Focus on everything that you are grateful for, communicate this, and open yourself each day to the best possible consequences.

Click here to download the full PDF version.

Final Thoughts

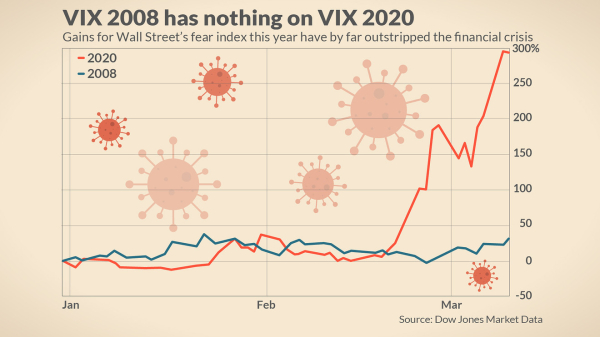

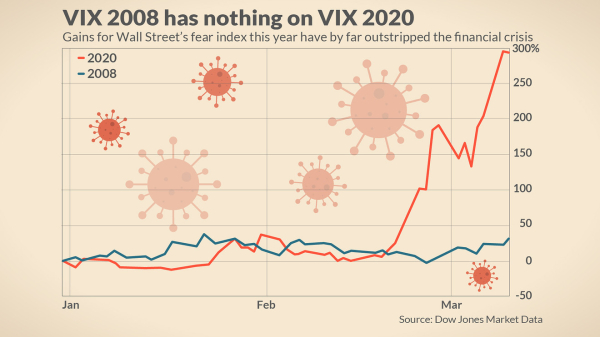

The VIX (Cboe Volatility Index) is regarded as the "Fear Index". On Monday, it screamed "Fear" (jumping to levels not seen since the 2008 crash). Even more interesting than the one-day jump was the year-to-date increase in volatility.

via MarketWatch

via MarketWatch

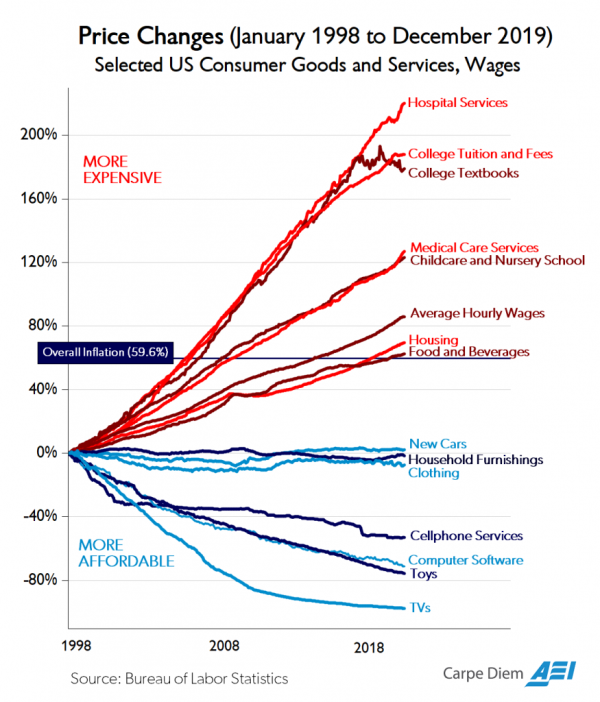

To me, this shows how uncertain and anxious the average "trader" is with various global trends. We can pontificate all day long on the short-term causes of the rises and falls of markets, but I don't think it does much good. I let the algorithms worry about those. It's the larger trends we have to be personally cognizant of.

I sound like a broken record, but volatility is the new normal.

- Markets exist to trade, and if there's no "excitement" on either side, trades don't happen

- Trades are getting faster, which means more information has to confuse both the buyer and the seller

- You're no longer competing solely against companies and traders like you. It's like the cantina from Star Wars, you've got a bunch of different creatures (and bots) interacting and fighting with each other, trying to figure out how to make their way through the universe

Pair that with all the fear and uncertainty and you've got a recipe for increased volatility and noise. That means that the dynamic range of a move will be wider and happen in a shorter period of time than ever before. You'll hear me echo this thought over the next few years as the ranges continue to expand and compress. Cycles that used to play out over weeks now take days or hours. The game is still the same, it just takes a slightly different set of skills to recognize where the risks and opportunities are.

Today's paradigm – both in life and in trading – is about noise reduction. It's about figuring out what moves the needle and focusing only on that.

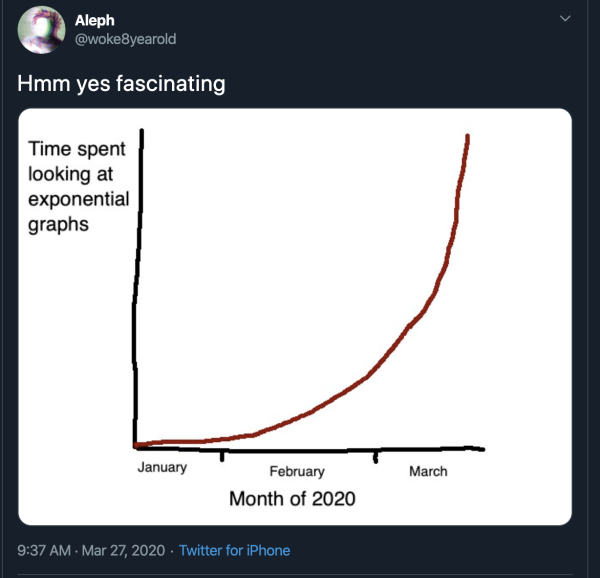

The crucial distinction is between adding data and adding information. Adding more data does not equal adding more information. In fact, blindly adding data increases your chances of misinformation and spurious correlations i.e. watching Fox News or MSNBC to listen to their news reports on COVID-19.

My final comment is that there's a difference between investing and trading, and while humans can invest if you're "personally" still trying to trade – you're playing a losing game. If you don't know what your edge is, you don't have one.

If you're investing, then I'll advise you to act like a robot. If you removed human fear and greed from your decision making – what would you do?

Keep calm and carry on.

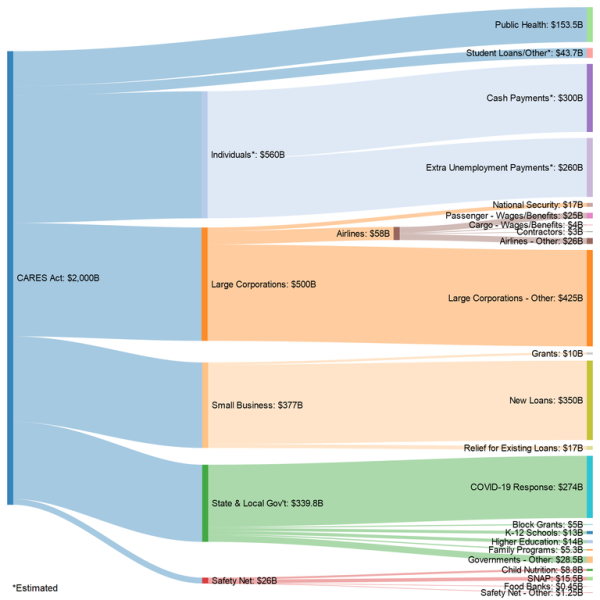

via Twitter

via Twitter SevenandForty via r/DataIsBeautiful

SevenandForty via r/DataIsBeautiful

via FinViz

via FinViz via

via  via

via

via

via