Peak Capital is running an online roundtable in November with our CIO John DeTore, John Mauldin, Sam Stovall. You can check with them to get the full answers from the various panelists, but I wanted to share some of John's answers ahead of time.

It's a lot of information, so I'm going to split it between two weeks.

November 2019 PCM Roundtable

Peak: Let's kick things off in a very different way. It is April 2021 and we just completed the first 100 days of the Warren Administration. What are you most concerned or excited about?

John:

- Finding the bottom of the US stock market.

- Concerned because there is further to go.

- Excited because of my short positions.

(Listen, I can see that she is trying to do good things for humanity: Free healthcare, tuition, and so forth will help people. But, ahem, it isn’t free, is it. Taxpayers pay for it. So, the stock market "don’t likey".)

Despite one’s political leanings, and there are a lot of interesting ideas being kicked about, the market will hate a flirtation with socialism. The market is probably off 20% from November 2020 (or its previous high if it became obvious she was winning earlier than November). Many analysts in April 2021 are looking for a bottom. They are early.

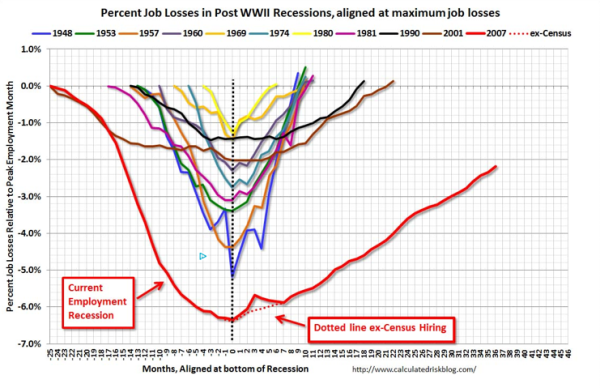

Remember the Obama recovery? (in RED below, it's the only one where the recovery is obviously not symmetrical.) While he shouldn’t be blamed for the financial crisis he inherited, he immediately moved to work on healthcare while we were in the depths of the crisis. Taxes increased, and regulations expanded. We can see how that recovery was different than any other in recent history, drawn around 2011:

I doubt that Warren will do any better with the economy and I fear she will do worse.

Thinking about how inaccurate political polling has become, I believe economic forecasting errors have also risen dramatically. Formerly reliable indicators and data points seem less reliable in today's market. How are you addressing this reality?

Statistical analysis is relatively easy and can be learned in a few college classes. Forecasting is maddeningly hard and often largely based on the forecaster’s training, assumptions, biases, and experience.

What happened to the notoriously inaccurate polls of 2016?

Party affiliation, likelihood of voting, age, sex, state of residence all affect candidate choice — even the most careful survey will find that the sample pool is different than the total voting population. All pollsters adjust their sample demographics to what they assume the voting population is. But how many of each will show up on the big day?

Many pollsters in 2016 assumed they could use the turnout in 2012. The election had a large black, young, liberal turnout … are we surprised given the first black U.S. president was elected? Did we think Hillary would get the same response? Most pollsters did, but does that make sense? Several pollsters who saw Trump as having a decent chance were publicly describing this specific statistical error.

Regarding economic forecasting: It suffers from the same phenomenon.

Example: we can dutifully correlate “yield curve inversion” to subsequent recessions. And I read about this about 50 times a day when the curve inverts. But let’s look a little deeper:

- A simplified theory: 10-year Treasuries represent a market view of forward inflation. As such, we might suggest it’s a nice neutral point for Fed policy to set the Fed Funds rate. (Maybe a little lower because we believe in term premium but let us not split hairs.) If the Fed pushes up short rates higher than this, it’s hitting the breaks. They tend to overdo things, causing recessions (occasionally on purpose?).

- Do we believe that 10-year Treasuries still represent a market view of inflation? There are reasons to be suspicious, with QE now affecting long rates and a strange influence on foreign buying from markets with negative real rates.

- If long-rates are depressed below that of long-term inflation expectations, then I for one lose faith in the usefulness of the indicator.

- (For what it's worth, I think rates are set by the supply and demand for bonds. The supply is going through the roof given deficit spending. I can reach no other conclusion that demand is growing faster. I suspect Dodd-Frank, Basel III and the like for creating new sovereign debt demand. If someone has data on this, write to me!)

Economic forecasting is an art best practiced by people who understand the economy. Which means most of us should stop doing it.

Peak: How will the trade war with China get resolved?

John: It won’t. Trump famously started his trade war tour with claims that it's easy to win a trade war with China because they have so much more to lose. He thought they would be the first to resolve USMCA, the UK post-Brexit, Europe, and various Asian markets would follow … even India.

He is correct they have more to lose … much more, since they hardly buy anything from us. But to me, this was an obvious tactical mistake by the master negotiator. President Xi feels no pressure. His limo still has fuel, his meals are still exquisite, and there is no political pressure on him. It would benefit their economy to cave to Trump, but they have no incentive. They play the long game.

Trump is right to pressure them and even to play hardball. We might get real intellectual property relief. It will be quite a slog … my prediction is there will be a string of broken promises, and once we have concessions they won’t live up to their end of the bargain.

If Trump is really hard on them, they will just drag their feet for 5 years and try again. It will shave a couple of percent off their GDP. No one in China will complain.

Peak: What is the long-term impact of Brexit?

John: I fear the real result is to box Brussels into a difficult position. The UK is leaving because politically the EU is too left-leaning and quick to impose their views on member countries. The UK will survive this better than the EU will. The only saving grace is that the UK was a reluctant participant in the first place … retaining the Pound as their currency.

This does open the possibility, though, that the relations with one of our strongest partners improves. US-UK relations are due to be renegotiated and this could be material. In fact, to me this looks like the UK is trading in Europe for the US as their best buddy. I think they will do fine.

Worry it hurts Europe.

Peak: Is impeachment a threat to the stock market?

John: Continue to believe this is political theater and not a serious impeachment case. It's unclear what the charge is or whether the house will even take a vote.

As an influence on the market, its probably already there. For instance, if the impeachment effort dissolved, it would be enough for the stock market to eek up to new highs, maybe breakthrough.

But if the market begins to believe that the Senate could actually convict … the market would react badly.

Peak: Could the Turkey-Syria conflict spiral out of control?

John: It could. It’s not clear how badly this could hurt the US economy though.

I doubt any of us really know what is going on behind closed doors. The U.S. has no primary fight in that battle. Turkey, Russia, and Iran all have strategic interests. We have issues with all three, but if “the enemy of my enemy is my friend” what we are really all about is diminishing Iran’s influence.

We will not be obvious about what we want. It will not be public what is being said to Putin and Erdogan. It will be a quagmire of deception and influence.

But it won’t shave multiple percents off our GDP or cause our stock market to drop 10%. (If it does, BUY)

Peak: Recessions are typically not formerly declared until months after they actually began. What is the probability the U.S. economy is in a recession by next June that would impact the 2020 election?

John: The economy is strong, unemployment low, confidence high. There are small snippets of bad news that come out all the time and are ignored by the stock market.

The question implies, I think, that GDP would decline both in the 1st and 2nd quarters of 2020.

The combination of full employment, strong profitability, and very low rates rarely ever happens. When you are at the summit of a mountain, every path leads downhill. It's not that things aren’t good, they are. It’s just that it’s hard to see them improving much from here … every macroeconomic variable is maxing out.

Certainly, it could happen. After many months of >200K new payroll, we are reaching what could be called full employment. We have worked our way through a shadow economy of functionally unemployed, returning people to the workforce that was shed in the 2008 financial crisis (they weren’t retired after all). Interest rates are of course very low.

It would take more than this to really hurt the stock market though. Over the long-term, it’s surprising how S&P forecast eps yield are tracked by 10-year Treasuries.

- That forward eps yield is now 177/3022=5.9%! Even the dividend yield is 1.9%, ahead of the 10-Year’s 1.8%.

- While I don’t expect the eps yield to fall to 2% (which means the P/E ratio would head to 50x!), it is reasonable to think in this environment (strong economy, strong earnings and growth, and paradoxically very low rates) the multiple should be above average, and it’s not.

Leave a Reply