I saw this article on SentimenTrader. Thought it was worth sharing.

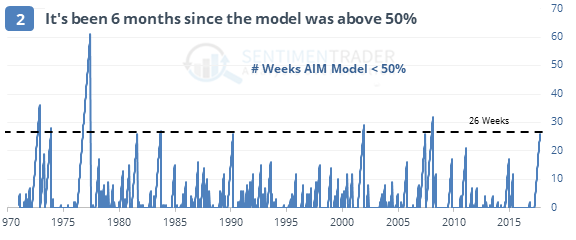

Maybe bulls are just superstitiousEven though investors are buying, they won’t say they’re bullish in sentiment surveys. The Advisor & Investor Model (AIM) is a model that averages the momentum of the four major sentiment surveys. It has been below 50% for 6 months, one of the longest streaks since 1970.via SentimenTraderNobody wants to shortAmong active investment managers, even the most bearish one is betting on a rally, which is a break from other surveys which mostly show apathetic sentiment. Unlike other surveys, this one has less of a contrarian bent, however.Call buyers returnOn the ISE exchange, recently, there were more than 200 call options bought for every 100 puts. That’s typically interpreted as a sign of excessive optimism from options traders.So, how are you feeling about the markets. Let me know.

Leave a Reply