Regardless what you're trading, the VIX can be a helpful index to monitor.

The VIX is an index that's commonly known as the "fear gauge." It tracks how quickly asset prices move (or, in other words, their "volatility").

While you can't invest in it directly, you can invest in derivative products like VIX futures, ETFs, inverse ETFs and more.

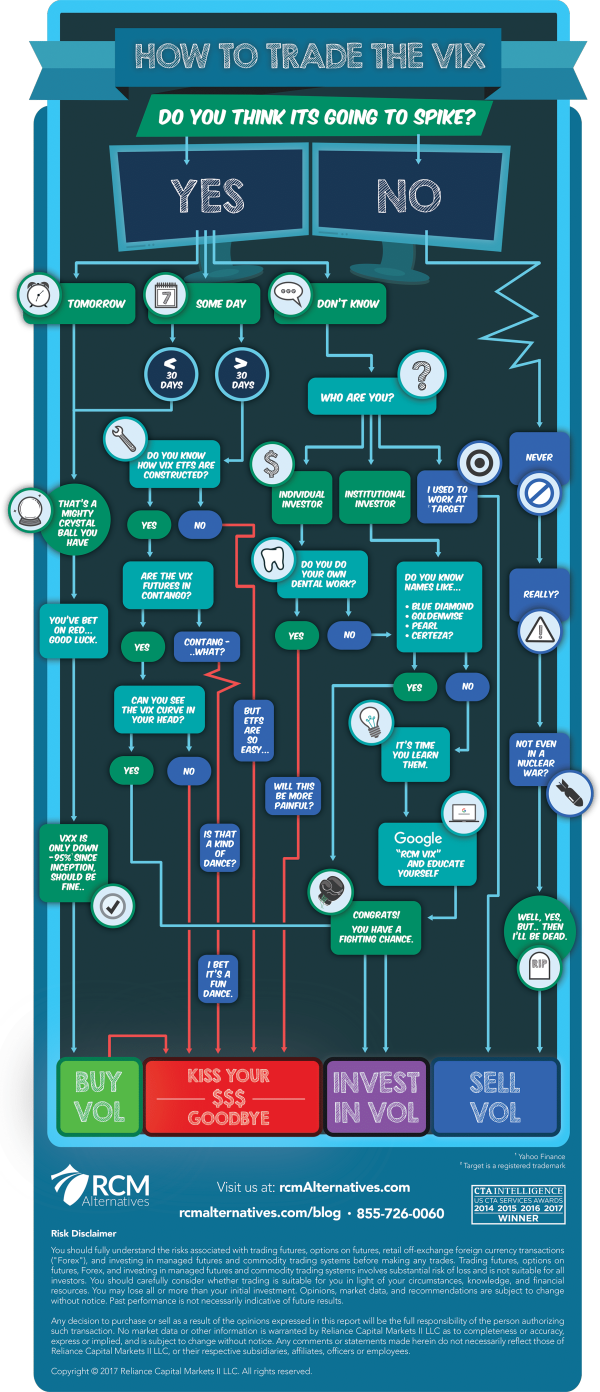

The infographic below is a good primer, and you can download RCM's full whitepaper here.

VIX trading volume is increasing nicely. Meanwhile, it is also a valuable data source.

I'd love to hear how you use it.

Leave a Reply