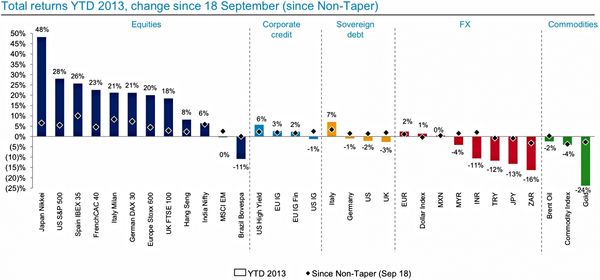

The Federal Open Market Committee's surprise decision to refrain from announcing a tapering down of its quantitative easing program on September 18 has given a lift to a variety of markets around the world.

The chart below highlights returns across asset classes — both in the year to date and since the September 18 decision.

via: Business Insider

The orderly returns by asset class surprised me (Equities, Credit, Debt, FX, then Commodities). It also surprised me that the biggest winners since the Fed decision were Spanish and Italian equities.

What about you?

Leave a Reply