When did playing 'smart' start to mean that you were a cheater?

Recently, Apple got grilled for its low-tax strategy. While not every business can, or does, copy that approach … many do.

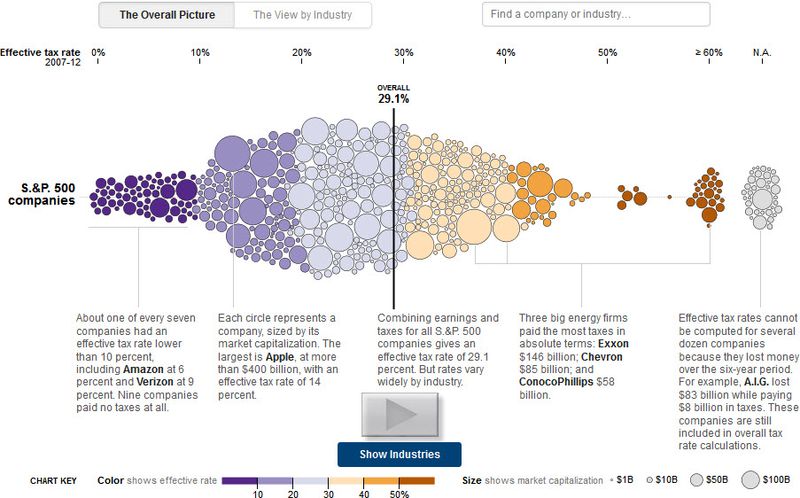

Here is a look at what S.&P. 500 companies paid in corporate income taxes — federal, state, local and foreign — from 2007 to 2012, according to S&P Capital IQ.

Click here to read the NYTimes article this infographic came from.

At its core, our democratic process and legal system were designed to take care of issues like these over time.

Likewise, our free market system will adjust to level the playing field. There is game theory in government. If you make things too difficult, the smart players find a different game to play.

Meanwhile, other countries certainly are incented to find a way to make to entice big players to play on their turf … and creating a tax haven is one way to do it.

Going back to Apple, on one hand I'm sure the government wishes they had paid more taxes, but on the other hand I'm sure they are glad that Apple didn't move away and take their tax dollars with them.

As you have probably surmised, this happens on many levels and in many places.

In trading, for example, statistical arbitrage was once an easy way to make money (if you knew how to do it). The reason was that relatively few people knew how to do it, so there was limited competition (and fairly easy winnings). Then, as the success of the early winners signaled others into the game, it got harder to win. People started programming computers to find mis-priced assets and the discrepancies filled themselves in moments. As you might guess, many traders who have tried statistical arbitrage have moved on to other things.

Identifying inefficiencies (or loopholes) in a system is potentially good for everyone involved. It benefits the person who identifies the inefficiency, because they get paid. Yet, it is also good for the system because it identifies weaknesses or areas that need additional attention, oversight, or regulation. And it provides a feedback loop allowing the parties to course-correct and play smarter. Over time, this often results in real progress.