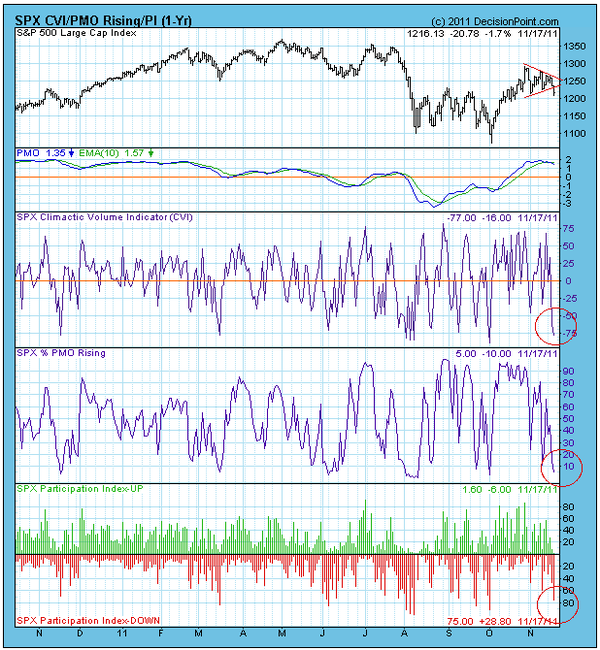

Our markets remain oversold on short-term charts.

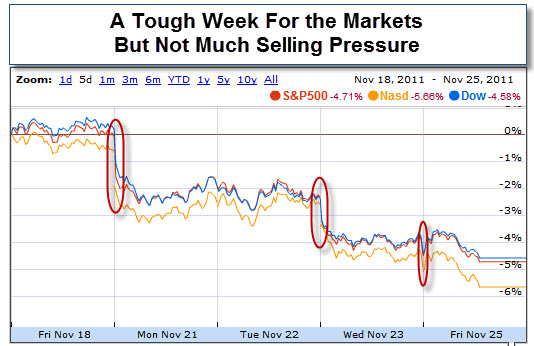

However, while last week was tough on the Markets, a quick glance shows that selling was relatively contained.

Without committed sellers, it won't take much to prop things up again. However, without the liquidity of organic buying, the Markets remain vulnerable to fear, uncertainty and doubt.

As you know, the news out of the Euro-zone has not been good. There are bank problems, an inability to agree on solutions, yields rising, and sentiment crumbling. As a result, traders worry that we'll miss this year's Santa Claus Rally. Nonetheless, conventional wisdom says not to short a dull market.

At a time when interest rates are historically low, we are seeing strong out-flows of cash from funds and almost no new money entering to buy stocks. At this point, it seems as though people are more interested in 'not losing' rather than worrying about how much they can make on their money.

This is when careful trading trumps hopeful seasonality. Consequently, expect traders to be on the look-out for short-term opportunities and diversification into other markets.