Imagine from Playing For Change Foundation on Vimeo.

Here is a link to "Stand By Me". And here are more Playing For Change videos.

Song Around the World.

Imagine from Playing For Change Foundation on Vimeo.

Here is a link to "Stand By Me". And here are more Playing For Change videos.

Song Around the World.

Imagine from Playing For Change Foundation on Vimeo.

Here is a link to "Stand By Me". And here are more Playing For Change videos.

Song Around the World.

The Markets are up, so all is well. Meanwhile, Obama Claus is suited-up and ready to continue delivering the debt. Consider it our gift to future generations …

Market Commentary

The S&P 500 Index remains at the top of its trading range and is making new highs for the year.

Watch For Weakness as Breadth Weakens.

Notice the negative divergence, marked by the red arrow. While the S&P 500 Index surged higher, less than 80% of the stocks in the index are trading above their 50-day moving averages. This means that not all stocks have been participating in the current rally, which is a potential warning sign of impending weakness.

Looking For a Positive Sign?

Lumber is surging. Moreover, the Homebuilders SPDR and the Home Construction iShares both are showing strength. This may show an increase in demand and often implies more construction.

Seems like good news to me. Jim Cramer recently advised: "It is never too late to change. Things are good, not bad. Don't play irony. Don't be too skeptical. Be opportunistic." What do you think?

The Year-End Bespoke Roundtable.

At the end of each year, the big financial media outlets typically conduct roundtables to get outlooks from key players in the financial markets. The Bespoke Roundtable asks twelve of the most popular financial blogs/websites the same 34 questions regarding their 2011 outlooks and their take on 2010. There are many insightful tidbits worth thinking about.

The consensus view is that the S&P 500 will be up in 2011, bonds will be down, oil will be up, the dollar will be up, US home prices will be up, and China's stock market will be up. Interestingly, the consensus view was the exact same as it was last year for all asset classes except for gold. Less participants think gold will go down in 2011 than they did in 2010. Here is the link to the full post.

Business Posts Moving the Markets that I Found Interesting This Week:

Lighter Ideas and Fun Links that I Found Interesting This Week

The Markets are up, so all is well. Meanwhile, Obama Claus is suited-up and ready to continue delivering the debt. Consider it our gift to future generations …

Market Commentary

The S&P 500 Index remains at the top of its trading range and is making new highs for the year.

Watch For Weakness as Breadth Weakens.

Notice the negative divergence, marked by the red arrow. While the S&P 500 Index surged higher, less than 80% of the stocks in the index are trading above their 50-day moving averages. This means that not all stocks have been participating in the current rally, which is a potential warning sign of impending weakness.

Looking For a Positive Sign?

Lumber is surging. Moreover, the Homebuilders SPDR and the Home Construction iShares both are showing strength. This may show an increase in demand and often implies more construction.

Seems like good news to me. Jim Cramer recently advised: "It is never too late to change. Things are good, not bad. Don't play irony. Don't be too skeptical. Be opportunistic." What do you think?

The Year-End Bespoke Roundtable.

At the end of each year, the big financial media outlets typically conduct roundtables to get outlooks from key players in the financial markets. The Bespoke Roundtable asks twelve of the most popular financial blogs/websites the same 34 questions regarding their 2011 outlooks and their take on 2010. There are many insightful tidbits worth thinking about.

The consensus view is that the S&P 500 will be up in 2011, bonds will be down, oil will be up, the dollar will be up, US home prices will be up, and China's stock market will be up. Interestingly, the consensus view was the exact same as it was last year for all asset classes except for gold. Less participants think gold will go down in 2011 than they did in 2010. Here is the link to the full post.

Business Posts Moving the Markets that I Found Interesting This Week:

Lighter Ideas and Fun Links that I Found Interesting This Week

Shopping is crazy during the holiday season. Here is a picture of someone who drove their car into a Walmart because the line was too long.

If you are looking for a good deal and want to avoid crowds, try the Camel Farm.

It's a strange name … and a great site. They provide historical price charts for Amazon and other retailers — so you know you are getting a great deal. Here is an example, but you can choose any product. It works great.

They also will send you price drop alerts via email, and have an intuititve system to help you find deals.

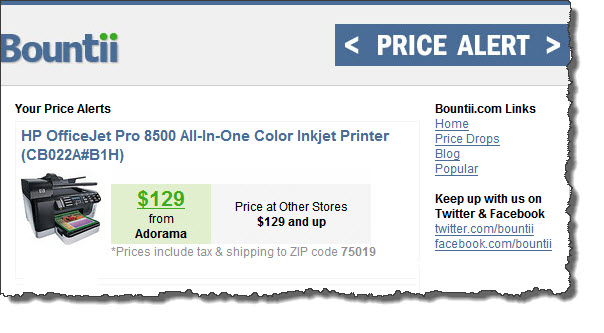

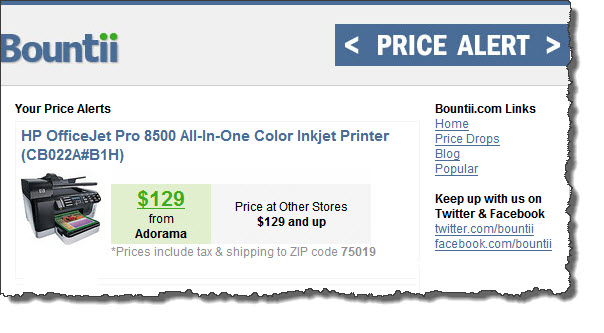

Another service I like is Bountii.

You can look here for other shopping tools and services.

Keep shopping. The economy needs you.

Shopping is crazy during the holiday season. Here is a picture of someone who drove their car into a Walmart because the line was too long.

If you are looking for a good deal and want to avoid crowds, try the Camel Farm.

It's a strange name … and a great site. They provide historical price charts for Amazon and other retailers — so you know you are getting a great deal. Here is an example, but you can choose any product. It works great.

They also will send you price drop alerts via email, and have an intuititve system to help you find deals.

Another service I like is Bountii.

You can look here for other shopping tools and services.

Keep shopping. The economy needs you.

While there, this sign caught my eye. A fake Obama urges users to buy genuine Microsoft.

Meanwhile, Obama and the Fed Declare That Market Gains are Genuine.

Here is a chart showing that the Dow Jones Industrial Average is trading near its recent highs.

Time will tell if the rally holds. Many traders are happy that the markets have worked-off some of the over-bought condition without a major pull-back from recent highs. It seems like a healthy base for a Santa Claus Rally.

Business Posts Moving the Markets that I Found Interesting This Week:

Lighter Ideas and Fun Links that I Found Interesting This Week

While there, this sign caught my eye. A fake Obama urges users to buy genuine Microsoft.

Meanwhile, Obama and the Fed Declare That Market Gains are Genuine.

Here is a chart showing that the Dow Jones Industrial Average is trading near its recent highs.

Time will tell if the rally holds. Many traders are happy that the markets have worked-off some of the over-bought condition without a major pull-back from recent highs. It seems like a healthy base for a Santa Claus Rally.

Business Posts Moving the Markets that I Found Interesting This Week:

Lighter Ideas and Fun Links that I Found Interesting This Week

This made me smile.

Ah, the good old days. "We told them the wealth would 'trickle down'."

Now, watch video titled “Obama Kicks Door” spoofing the President’s reaction after extending the Bush Tax-Cuts. While Jay Leno’s Tonight Show obviously faked the video, they probably nailed the President’s reaction to the compromise. Here it is.

via RightPundits.com.

This made me smile.

Ah, the good old days. "We told them the wealth would 'trickle down'."

Now, watch video titled “Obama Kicks Door” spoofing the President’s reaction after extending the Bush Tax-Cuts. While Jay Leno’s Tonight Show obviously faked the video, they probably nailed the President’s reaction to the compromise. Here it is.

via RightPundits.com.