This latest round of quantitative easing is pretty straight forward. Bernanke isn't even pretending that that QE will actually benefit the real economy. His lack of pretense is almost brazen. For example, he posted this in an Op-Ed piece in the Washington Post:

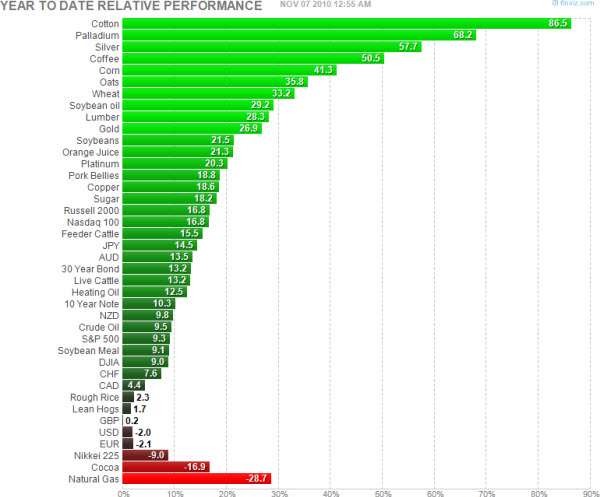

This approach eased financial conditions in the past and, so far, looks to be effective again. Stock prices rose and long-term interest rates fell when investors began to anticipate the most recent action.

Does it surprise you that Bernanke's evidence of success is that the market moved higher? Does it matter if the progress is tangible economic progress (or is improving against expectations enough)?

Of course, Bernanke hopes the wealth effect from stocks will be a catalyst to real economic gain; but to many analysts, it still reeks of manipulation and intentional bubble-blowing.

Taleb Is Saying That Ben Bernanke is a Serial Plane Crasher.

On one hand, Taleb is entitled to his opinions (even if he takes a few liberties with the facts). On the other hand, what I'm watching is how people (read, "the market") react. Here is a video of a recent Taleb media appearance.

So, what do you think the smart money is going to do?

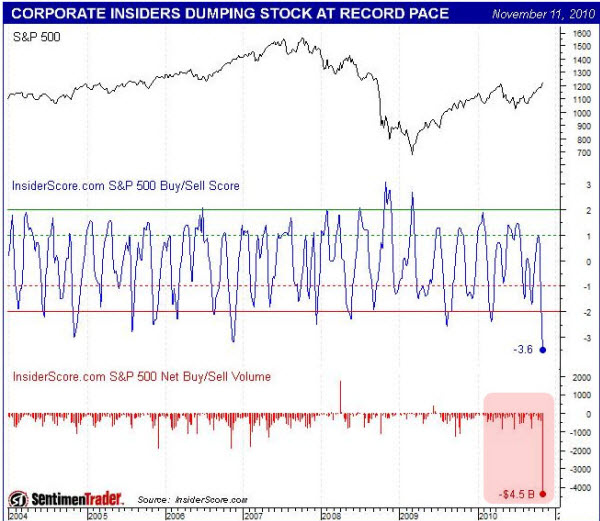

Corporate Insiders Dumping Stock at a Record Pace.

Quantitative Easing is supposed to drive stocks up, creating a wealth effect that restores confidence to the economy and spurs more business activity. However, insider selling is way up since the QE2 announcement.

Cisco had a big earnings miss, which sent its shares down 15%. Meanwhile, Cisco insiders had been selling stuck for the past six month. During that period, the scorecard shows 6.6M shares sold – and 0 shares bought; well played.

In fact, insider selling hit an all-time record last week. And it isn't over; Steve Ballmer disclosed that he will try to sell $75 million of his Microsoft stock this year.

A Note For Contrarians.

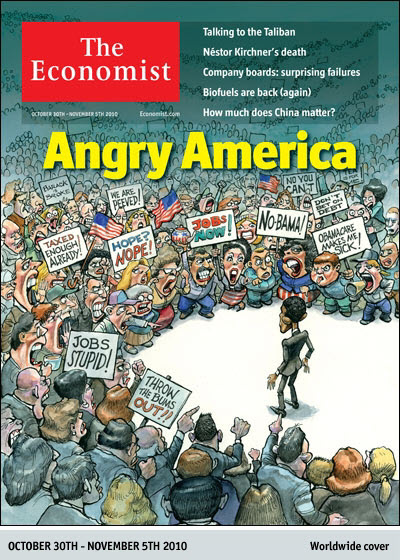

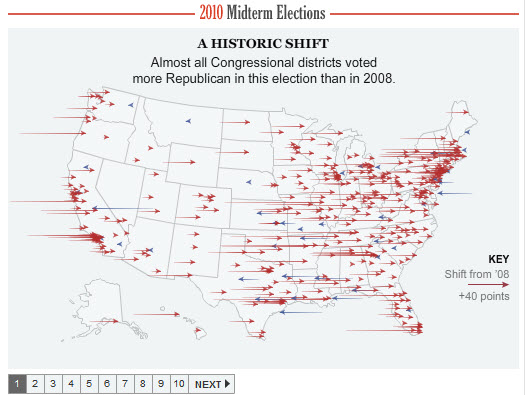

While insiders are selling and global markets are reversing, bullish sentiment soars. Small investor bullishness is back to 2007 levels! Traders will be watching for signs of weakness because this is what happens around a top.

The answer is … sure (it could be); but, probably not.

A trader reminds that the market "eats like a bird and poops like a bear". If the market is not "pooping" like a bear, then it is probably not ready to have a sustained correction.

Early indicators and theories are great because they remind you to pay attention. However, price is the primary indicator. As long as the market is going up, all we know is that it is going up (and to pay attention).

Business Posts Moving the Markets that I Found Interesting This Week:

- Is Bernanke Engaging In The Monetary Equivalent Of Nuclear War? (BizInsider)

- Jim Rogers Says the Fed's Bernanke "Doesn't Understand" Economics. (Bloomberg)

- G-20 Summit Ends with an Agreement to Disagree. (LATimes & TDB)

- Could We See a Global Monetary System That Puts Gold in the Mix? (WSJ)

- Beware Blanket Statements: like "Don't Fight the Fed". (CapitalObserver)

- More Posts Moving the Markets.

Lighter Ideas and Fun Links that I Found Interesting This Week

- Leadership Secrets of Winston Churchill (Forbes)

- The Next Shift: Social-Networking Services to Replace E-Mail. (TechCrunch & Gartner)

- Robot "Chatbot" Debates Climate Change Deniers via Twitter. (SmarterTech)

- Tracking Happiness: Is Daydreaming Linked to Bad Moods? (Newser)

- Twinkie Diet Helps Nutrition Professor Lose 27 Pounds. (CNN & TheWeek)

- More Posts with Lighter Ideas and Fun Links.