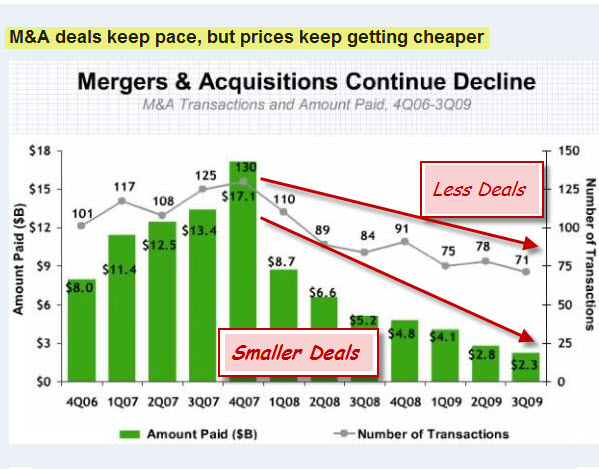

Mergers and Acquisitions are likely to increase before the next big bull run. This chart shows that we aren't there yet.

We're at the point in the economic recovery cycle where a lot of companies have folded, or will soon fold. On the other hand, the survivors are starting to see the clearing … or at least the light at the end of the tunnel. Consequently, I expect to see more merger and acquisition activity at the next pull-back.

This will help the strong get stronger … But it will also serve as a catalyst to new growth and new leaders.

M&A Isn't the Only Way.

This is a great environment to incubate what comes next. During downturns, some people lose their money, business, or hope. During that same period, other people recognize and seize the opportunity to create something great.

There so much talent on the street right now looking for work … yet there is even more looking for something that inspires them.

At the same time, technology continues to

get better. And that just means it continues to get cheaper and easier to implement

great ideas and scalable businesses.

Consequently, I think a lot of talent is going to switch from the confines of

corporate America to more entrepreneurial ventures. Bright minds will

shed cost-cutting cultures and management-by-committee for virtual

teams of talented individuals looking to innovate and operate more

nimbly.

Something Old is New Again.

Sometimes new things come from familiar faces. There are many

successful entrepreneurs who have been to the brink, and back. What's

interesting is that

they tend to succeed faster, later in their

careers. It makes sense if you think about it; losing money or facing a

setback doesn't take away the other skills that they had … so their

next venture is easier for them simply because they

are more experienced and better seasoned.

Nonetheless, I'm confident that we will soon see a new wave of

the business leaders emerge. I'm curious who you think the likely winners will be?

Leave a Reply