When America voted for Hope and Change – I don't think they expected to be hoping for a dollar and settling for two dimes, a nickel and a penny.

Market Hits New Crisis Low:

It has been ugly. One sign that the Markets are having trouble is that Gold touched $1,000 for first time in a year.

Another sign the markets are having trouble? The Dow Jones Industrial Average now has lost

nearly half its value, breaking to a new six-year low.

On one hand this seems to confirm people's fears that stock

declines aren't over, and dashes

hope for a quick market recovery. On the other hand, things don't bounce till they hit bottom.

Will dry powder ignite the stock market? One bullish argument rests on the

piles of cash sitting in bank accounts and money-market funds earning

next to no interest. As deal-maker's fingers get itchy and companies

get more desperate for cash, many expect a flurry of deals.

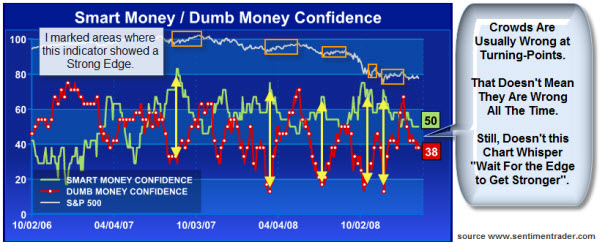

This Week's Chart:

Unlike the Dow, the S&P 500 has not made new lows. It did, however, just break a clear trend-line.

Most major US equity indices have been in a "Triangle" consolidation pattern (like the one shown in the chart above).

You can think of the Triangle as a well-contested battle between the bulls and the

bears. Neither side has given-up much ground, yet. Soon, though, one

side will have had enough and the market will surge again. If it is a move up, then we get the relief rally people were looking for. Even if you get a minor move down in the short-term, it can be constructive. Here is why.

The bear-swing down, from October through November, had a lot of

momentum. The consolidation worked-off a lot of that. Consequently,

another move down would result in many positive divergences – and would

likely be strong support for the next rally.

That doesn't mean the Bear Market would be over. But an intermediate term rally would not surprise me here. Especially as an OOPs trade.

Here Are A Few Of The Business Posts I Found Interesting This Week:

- Can This Be True? Federal Obligations Exceed GDP of Entire Planet. (WorldNet)

- Pledge of $275 Billion to Cut Mortgage Payments & curb foreclosures. (Bloomberg)

- Soros Sees No Bottom For World Financial Collapse, And Volcker Agrees. (Reuters)

- Economists' Droopy Outlook for the US. (WSJ & Bloomberg)

- Harvard Prof’s Plan for Saving the Financial System. (Creative Capital)

- Is Starbucks a Leading Indicator of the Economy? (Inquirer)

- Be Leery of Dow Theory – Does It Still Mean What It Used To? (Barrons)

And, A Little Bit Extra:

- Nature Versus Nurture: The Dynamics of Success. (TraderFeed)

- Clever E-Cards For Many Occasions – Very Funny Stuff. (Someecards.com)

- The Biology of Dating: Why Him, Why Her? (Time)

- Psychologists' Worry: Medication May Erase Bad Memories. (MSNBC)

- "Deliciously Gross" Heart-Attack Inducing Food. (This Is Why You're Fat)

- Vintage Tobacco Ads; Apparently They'd Do Anything To Sell You Cigarettes. (Click)