There is nothing wrong with your television. We will control all that you see and hear. We can deluge you with a thousand channels or expand one single image to crystal clarity and beyond. We can shape your vision to anything our imagination can conceive. Enjoy ….

The original,, from The Outer Limits TV show was:

There is nothing wrong with your television set. Do not attempt to adjust the picture. We are controlling transmission. If we wish to make it louder, we will bring up the volume. If we wish to make it softer, we will tune it to a whisper. We will control the horizontal. We will control the vertical. We can roll the image; make it flutter. We can change the focus to a soft blur or sharpen it to crystal clarity. For the next hour, sit quietly and we will control all that you see and hear. We repeat: there is nothing wrong with your television set. You are about to participate in a great adventure. You are about to experience the awe and mystery which reaches from the inner mind to the outer limits.

As a society, we're fairly vulnerable to groupthink, advertisements, and confirmation bias.

We believe what we want to believe, so it can be very hard to change a belief, even in the face of contrary evidence.

Recently, we've seen a massive uptick in distrust toward news agencies, big companies, the government, and basically anyone with a particularly large reach.

To a certain degree, this is understandable and justified. Here is an example of the power of the media focused on a message. Click to watch.

via Courier News

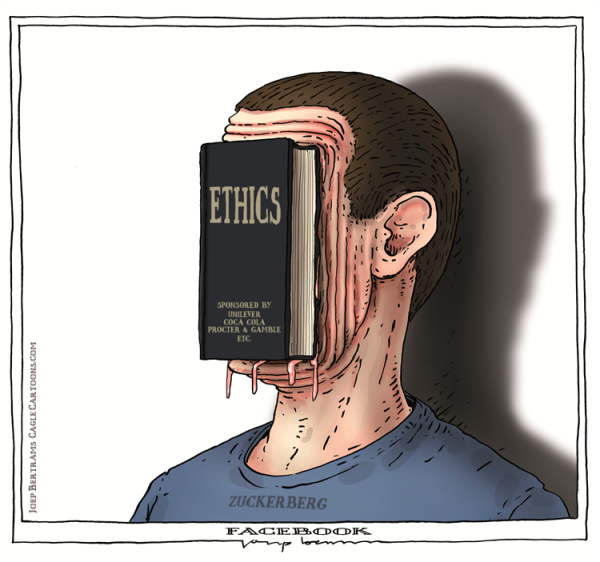

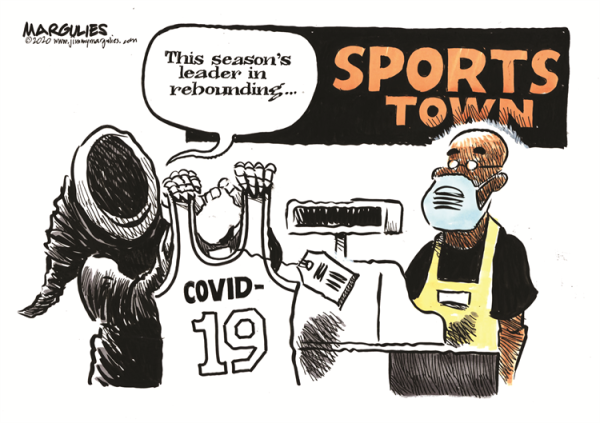

Propaganda has always been an issue, and almost everyone does it; governments, companies, etc. Luckily, it's easier to see today than in the past, but unluckily it's also more pervasive and insidious than before.

It's to the point where if you watch the news you're misinformed, and if you don't watch the news you're uninformed.

The above segment portrays a rosy picture of Amazon's efforts to protect its workers while delivering essentials to the struggling homebound masses. This comes while Amazon has come under massive fire for removing some of its protections.

Honestly, I use Amazon and, in my opinion, this isn't a massive breach of trust. News stations have a lot of time to fill, they often have sponsored content.

That being said, it's something to be cognizant of – not necessarily offended by.

Personally, I believe I am reasonably aware and somewhat immune from propaganda. That probably isn't as true as I'd like to believe.

It used to be true that winners wrote history (think empires, wars, etc.). Now, the one that delivers the most broadcast narratives shapes the emotional and seemingly logical responses to what we perceive to be happening around us.

The result impacts elections, financial markets, buying choices, and countless other areas of our life.

As A.I., Bots, and social media grow, our ability to discern truth from 'truthiness' weakens.

It's a great reminder that what you're seeing and hearing is carefully manufactured, and hopefully, it encourages you to get outside your bubble.

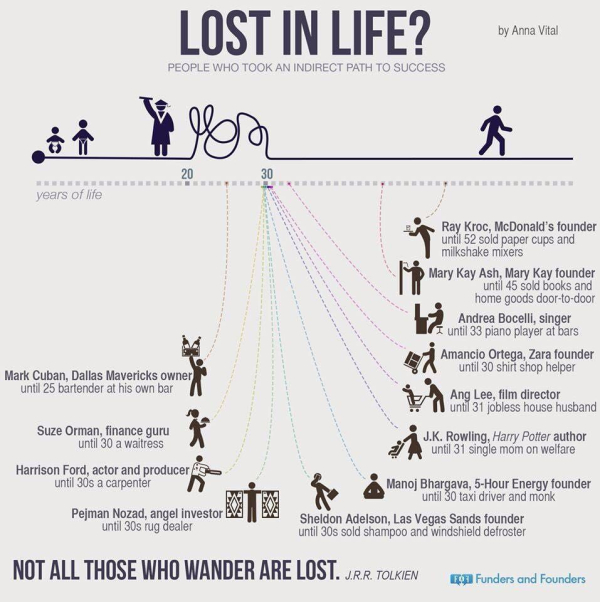

Anna Vital via

Anna Vital via

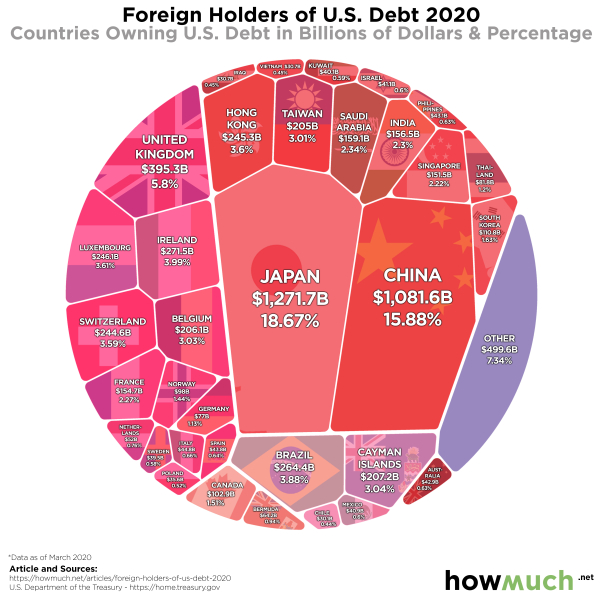

via

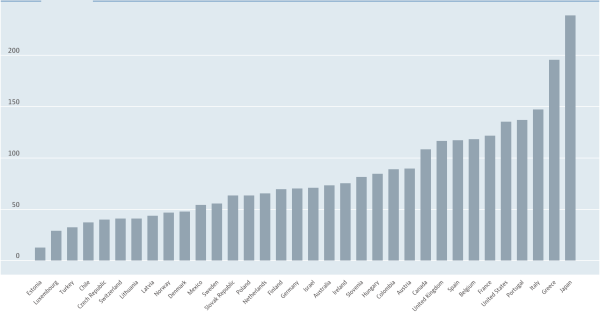

via

via

via

via

via