Do lower prices frighten people? Or, do fearful people cause lower prices?

On some level, it is clear that the ebbs and flows of a Market Chart represent the collective fear and greed of its participants. As more people get fearful, you have more sellers. As more people get greedy, prices catch a bid.

But what about you and me? Are we immune from the primal portion of our brains? As I was thinking about this, I saw the following quote:

"The thoughts they had were the parents of the actions they did; their feelings were parents of their thoughts."

-Thomas Carlyle (1795-1881)

It is true, isn't it? Thoughts flow from feelings. Or (at least) feelings affect thoughts. At some level, I've known this about many discrete areas of my life (motivation, relationships, etc.). Yet I've resist accepting this as a global truth.

Nonetheless, it makes sense that understanding (or at least recognizing) what you feeling is an important step in better thinking and better actions.

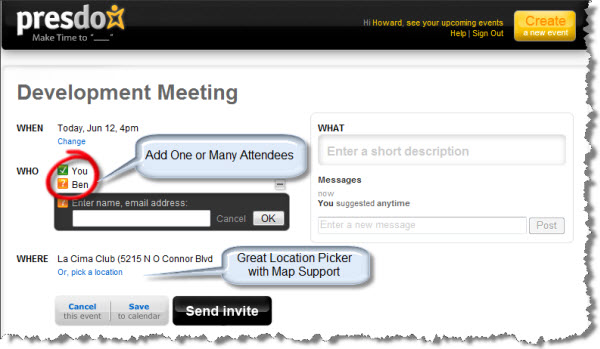

Likewise, if you are a discretionary trader, it might be interesting to note how your emotions affect your trading. For example, it is pretty clear that your emotional state can create an anchor point and context that affects

judgment and even the interpretation of market signals (for example,

whether or not to take a trade).

On any given day, I might get angry, happy, frustrated, excited or even

greedy. We all experience a range of emotions regularly, don't we? Yet from a trader's perspective, it might feel like nothing noteworthy is happening to them throughout the day. Why? Because traders are so used to the range of emotions they experience, experiencing them again simply feels "normal", and they learn to ignore them.

As a systematic and algorithmic trader, emotions still affect my day. That is why we follow the "rules" while the market is open. Discussions about changing rules or adding new rules happen after-hours (when the fear and greed simmer down and heads clear).

Clearly, many things can affect how and when a discretionary trader

trades. Identifying and recognizing when something affects you is the

first step towards mastering it.