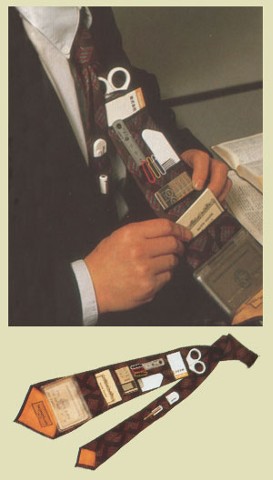

Chindōgu is the Japanese art of inventing ingenious

everyday gadgets that, on the face of it, seem like an ideal solution to a

particular problem.

When allergies bother you, why carry tissue?

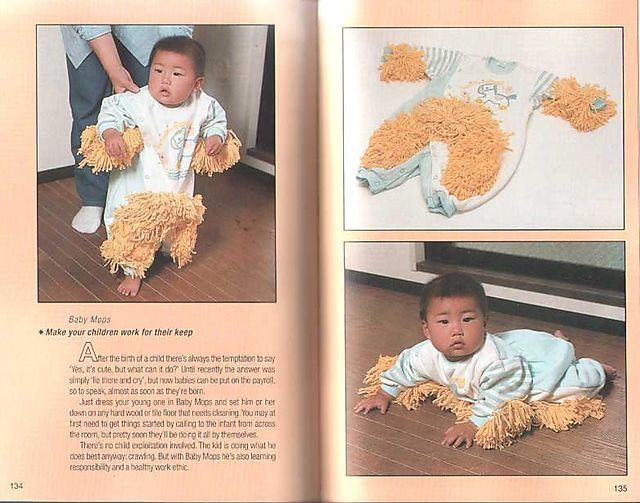

When you’re a busy parent and don’t have time to clean, why mop?

When you’re in the mood for a hot quickee, what you need is a good blow.

Don’t be a slave to fashion, be a salaryman.

Here are a few other links to see more of these. (Linkinn.net and Picdit)

While you are at it, translate your name into Japanese.