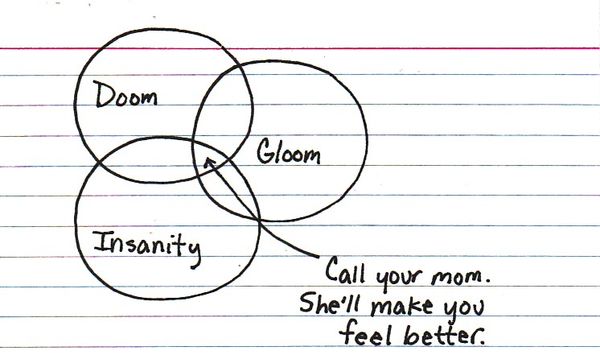

This drawing made me smile, even though the market continued down.

Sentiment is bearish; not surprising since we're at market lows not seen in 12 years. You know it's bad out there. But to put it in perspective, Bespoke presents some sobering stats in "Ugly Stock Stats From an Ugly Bear."

Adding to the market's concerns, here is a chart showing that Goldman Sachs slashed their S&P 500 Earnings Forecast. They are expecting a peak-to-trough decline of 56% (behind only the Great Depression and WW1).

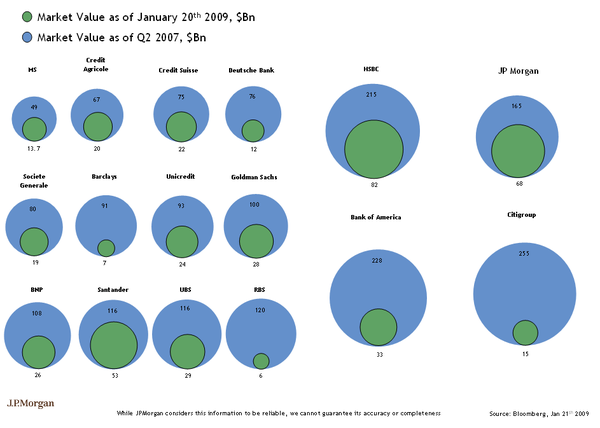

And here is a chart showing the deterioration of major bank market caps since 2007. The Blue Bubbles show market value in Q2-07, while the Green Bubbles show recent values.

(hat tip to Phil's Stock World)

Regardless of the data, the real question is whether it will get better or worse from here?

Here is a positive sign. Smart Money is starting to get more bullish (while retail investors continue to get more bearish). We are not yet at the levels that often signify rallies, but we are closer.

As we get closer to intermediate-term lows, I pay more attention to Sentiment measures. So I'll be keeping an eye on Trader's Narrative because they have lots of good content.

I added a feature to the website this week. A place where I link to the news that catches my eye. I'll continue to post the best links here, and I'll have a bunch more for you on the blog.

Here are a Few of the Business Posts I Found Interesting This Week:

- VC's Top-Ten Reasons Start-Ups Fail. (Tim Draper)

- What Warren Buffet Told His Shareholders? (CNBC)

- PDF of Buffet's Berkshire Hathaway 2008 Annual Letter to Investors. (BH)

- The Smart Growth Manifesto – It's Time to Reboot Capitalism. (Harvard Business)

And, Here are a Few More Lighter Ideas and Fun Links:

- A Nice Collection of Ancient Greek Wisdom and Quotes. (MSU)

- Nation Instinctively Forms Breadline – Gallows Humor. (The Onion)

- India Patenting Yoga Move to Protect Them from Western Pirates. (Neatorama)

- A Site for Amazon Kindle Users. (Kindle Nation)