This was a good week for bullish traders. Sure volume was light for the rally. But selling was even lighter. In a trending market, thinking too much can be detrimental to your wallet. And from March until now, the trend points up.

What Does the Bigger Picture Show?

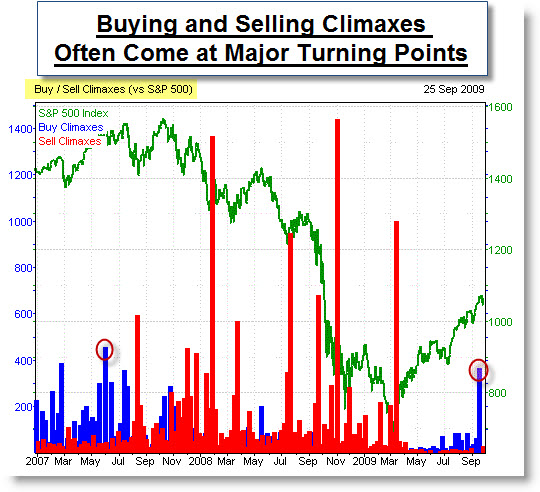

A weekly chart of the SPY, which is the ETF for the S&P 500, shows price coming into a cluster of resistance. There are three things that jump out at me. First, we are at the 50% Retracement of the October 2007 to March 2009 downswing. Second, price is also are trying to break through the long-term downtrend line from that bear swing. And third, there is a significant Gap (which often acts as resistance) at that same level from last October.

Can We Move Higher?

The market does not directly reflect the economy. So price can go

higher, even without a real economic recovery. For traders, the

question is how long the rally will be sustainable? The answer is

simple; it is sustainable until price breaks the trendline.

It is a little tricky, here, because we have the battle of two trendlines.

What About the Economy?

As for the economy, consumer spending has been weak, so expect that corporate revenues will continue to drag. And companies straining to realize their inflated expectations for 2010-11 earnings will continue to focus on cutting costs, which translates into cutting jobs. Unfortunately this likely results in even less consumer spending …

Where Are Consumers Spending?

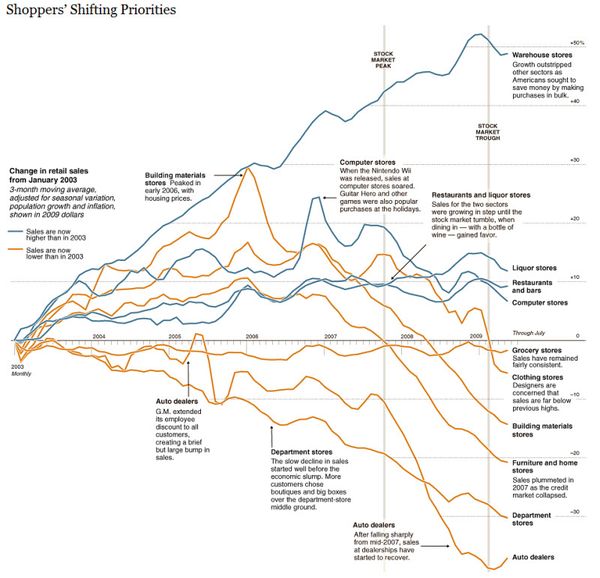

This chart from the New York Times tells an important story. It shows where consumers are spending … and where they aren't. Last year, consumers pulled back on spending and the retail sector suffered. But not all retailers are faring worse than they did a few years ago.

Against a baseline of spending levels in 2003, sales in computer stores have continued to rise. Restaurant and liquor-store sales are at much higher levels, and purchases at warehouse stores are up nearly 50 percent.

Still, in major retail divisions like home furnishings and clothing, sales faltered in 2007 and are now below their levels of 2003.

Does a Weak Dollar Matter?

This chart series from Bespoke highlights one reason that a weak dollar matters. While gold is at record highs in dollar terms, the commodity is still down 10% from its highs when priced in Euros or Yen. This indicates that the strength is a function of a weaker dollar rather than a real increase from demand.

The same logic applies to the recent market rally. If the dollar gets stronger, expect the market to move down. Consequently, many traders are watching the dollar as it tries to bottom.

The same logic applies to the recent market rally. If the dollar gets stronger, expect the market to move down. Consequently, many traders are watching the dollar as it tries to bottom.

Business Posts Moving the Markets that I Found Interesting This Week:

- What's Luck Got to Do With It? The Math of Gambling. (NewScientist)

- Women, Testosterone & Finance – Risky Business? (Economist)

- Private Equity's Return Dilemma – Hope Dwindling for a New Buyout Boom.(WSJ)

- Please Do Feed the Bears – The Financial World Needs Its Pessimists. (Economist)

- Return of Day Traders Drives Volume; But Who Is Sitting-Out? (WSJ)

- Uncommonly Clever Economic Indicators. (Forbes)

- More Posts Moving the Markets.

Lighter Ideas and Fun Links that I Found Interesting This Week

- Microsoft Offers Free Security Essentials Anti-malware Package. (InformationWeek)

- More Cases of Autism in U.S. Kids Than Previously Realized. (CNN)

- A Credible Kindle Killer? Competitors Team-up to Take on Amazon. (Forbes)

- Tracing the Origins of Human Empathy. (WSJ)

- Allocate Hours for Maximum Productivity in Your Perfect Day. (ETR)

- Samurai Mind Training for Modern American Warriors. (Time)

- More Posts with Lighter Ideas and Fun Links.