The Markets are up, so all is well. Meanwhile, Obama Claus is suited-up and ready to continue delivering the debt. Consider it our gift to future generations …

Market Commentary

The S&P 500 Index remains at the top of its trading range and is making new highs for the year.

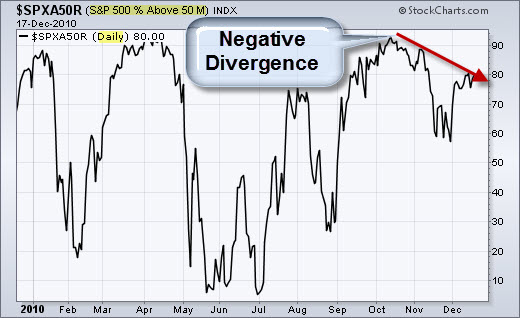

Watch For Weakness as Breadth Weakens.

Notice the negative divergence, marked by the red arrow. While the S&P 500 Index surged higher, less than 80% of the stocks in the index are trading above their 50-day moving averages. This means that not all stocks have been participating in the current rally, which is a potential warning sign of impending weakness.

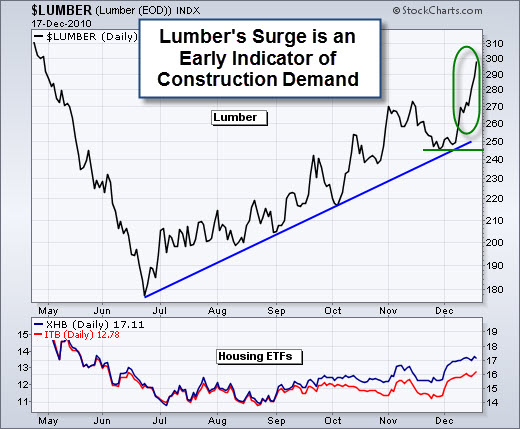

Looking For a Positive Sign?

Lumber is surging. Moreover, the Homebuilders SPDR and the Home Construction iShares both are showing strength. This may show an increase in demand and often implies more construction.

Seems like good news to me. Jim Cramer recently advised: "It is never too late to change. Things are good, not bad. Don't play irony. Don't be too skeptical. Be opportunistic." What do you think?

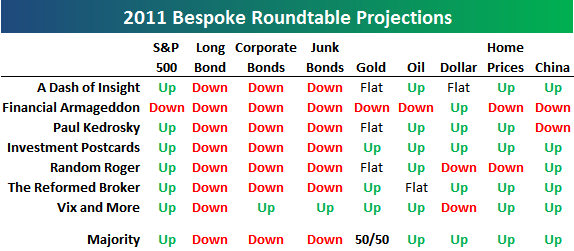

The Year-End Bespoke Roundtable.

At the end of each year, the big financial media outlets typically conduct roundtables to get outlooks from key players in the financial markets. The Bespoke Roundtable asks twelve of the most popular financial blogs/websites the same 34 questions regarding their 2011 outlooks and their take on 2010. There are many insightful tidbits worth thinking about.

The consensus view is that the S&P 500 will be up in 2011, bonds will be down, oil will be up, the dollar will be up, US home prices will be up, and China's stock market will be up. Interestingly, the consensus view was the exact same as it was last year for all asset classes except for gold. Less participants think gold will go down in 2011 than they did in 2010. Here is the link to the full post.

Business Posts Moving the Markets that I Found Interesting This Week:

- Is Worldwide Corruption on the Rise? (Time)

- Americans' Wealth Grows, Lifting Hopes For Economy. (AP)

- When Will China Overtake America as the World's Biggest Economy? (Economist)

- Currency: The Year of 'Printing Money'. (BizWeek)

- What Was the Biggest Market Event of 2010? (InvestorPlace)

- More Posts Moving the Markets.

Lighter Ideas and Fun Links that I Found Interesting This Week

- NASA Discovers New Arsenic-Based Lifeforms. (Newser)

- Apple Prepares New Camera-Toting iPads for Q1 Release. (Reuters)

- Hidden Code Found in the Mona Lisa May Reveal Her True Identity. (Newser)

- A Million Free Google Books in ePub – for Kindle too (KindleWorld)

- Adult Picky Eaters May Actually Have a Disorder. (MSNBC)

- More Posts with Lighter Ideas and Fun Links.