Traders are often confronted by mixed signals.

Personally, when I have to choose between something straightforward or something complex – I remember the phrase "simple is better".

For example, when large "Smart Money" traders show their directional bias, it often pays to follow in their tracks.

Another technique would be to bet against the smaller retail "Dumb Money" traders (because historically they are often wrong at major turning points.

However, if I have to decide between following "Smart Money" or doing the opposite of what "Dumb Money" does … then in the absence of other information, following Smart Money wins because it is more straightforward and simpler.

Here is an example.

Retail Investor Are Putting On Their Bear Suits.

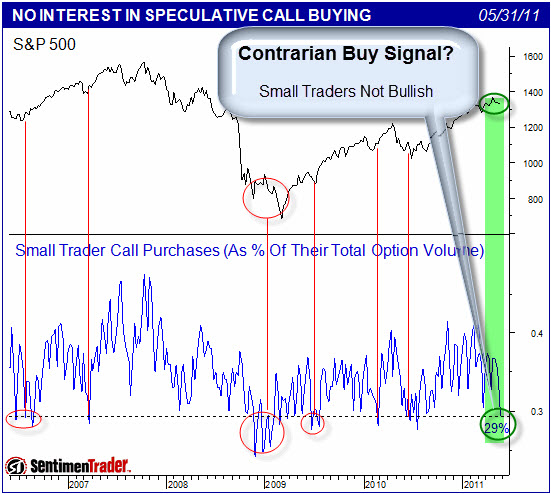

"Small traders" are showing extreme pessimism by buying a very low percentage of call options (bullish bets) compared to the total options purchased.

As a reminder, many traders consider excessive bearishness from small investors a sign that markets are set to go higher. This is considered a contrarian buy signal. The question is whether it is a reliable buy signal?

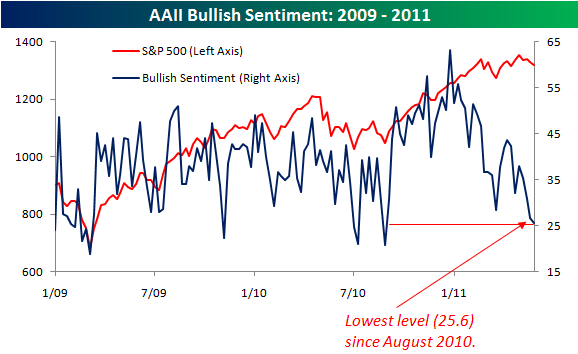

Over the last several years when this number gets below 30%, the market was at, or near, the start of another significant push higher. Here is a chart.

Something to consider is that the crowd is often wrong at major turning point because they are too bearish before a big push up (or too bullish before a big push down). Here, we may have a different situation. Small investors have lost confidence even though the markets are near recent highs.

Before we look at what larger "Smart Money" investors have been doing, let's look a little deeper into the Put/Call Ratio.

What Does the Put/Call Ratio Measure?

The Put/Call Ratio is an indicator that shows put volume relative to call volume.

Put options are used to hedge against market weakness or bet on a decline. Call options are used to hedge against market strength or bet on advance.

The Put/Call Ratio is above 1 when put volume exceeds call volume and below 1 when call volume exceeds put volume.

Traders use this indicator to gauge market sentiment because it shows what type of protection they are willing to purchase.

A Different Put/Call Ratio Suggests that Smart Money Is Looking for a Pullback.

Unlike the CBOE Total and Equity Put-to-Call ratios, the OEX Put-to-Call Ratio is not considered a contrarian indicator. Why? Because OEX options are normally traded by larger "Smart Money" traders.

Likewise, there is more put buying in the OEX because OEX options are one of the instruments that large money managers use to hedge their portfolios.

To put things in perspective, historically, Smart Money traders buy 100 to 150 puts per 100 call purchase. Consequently, a ratio hovering around 1.50 (150 puts purchased/100 calls purchased) is pretty normal. However, you must take notice when Smart Traders are buying puts hand over fist. Last week the Smart Money traders bought a little more than 3 puts per 1 call, closing the OEX Put-to-Call Ratio at 3.36.

ZorTrades posted this chart. It shows how often a high OEX Put-to-Call Ratio results in a market downturn. Click the image to see a larger version.

This chart marks the times where the OEX Put-to-Call Ratio has closed above 2.40 (meaning that Smart Money was buying more than twice the amount of puts than calls). As you might guess, the outcome has not been pretty when this has been the case. Notice above that 6 out of 7 occurrences resulted in significant moves down.

As my Dad used to say: "You can fool everyone some of the time; but you can't fool all of the people all of the time. Perhaps the small trader isn't always wrong? And, perhaps, simple is better.