A recent Quora post prompted the question, "What are some of the most mind-blowing facts that sound like 'BS', but are actually true?"

This video presents seven of those crazy-sounding facts.

Interesting.

Thoughts about the markets, automated trading algorithms, artificial intelligence, and lots of other stuff

A recent Quora post prompted the question, "What are some of the most mind-blowing facts that sound like 'BS', but are actually true?"

This video presents seven of those crazy-sounding facts.

Interesting.

A recent Quora post prompted the question, "What are some of the most mind-blowing facts that sound like 'BS', but are actually true?"

This video presents seven of those crazy-sounding facts.

Interesting.

What do you call someone who constantly asks for your advice, but doesn't take it?

Here are some of the posts that caught my eye. Hope you find something interesting.

What do you call someone who constantly asks for your advice, but doesn't take it?

Here are some of the posts that caught my eye. Hope you find something interesting.

The S&P 500 Index finally bounced.

Technicians sighed in relief as the S&P 500 had an oversold bounce near its April low support level. On a side note, Wednesday's price plunge marked a 62% retracement of the February-September rally.

The fact that the S&P 500 closed so far off its Wednesday low (in very heavy trading) also has the look of a potential "climax" bottom.

That's the good news.

The bad news is that the two day bounce on Thursday and Friday came on declining volume. In addition, the S&P 500 remains below its August low and 200-day moving average.

From a different perspective, there are many risks blame-worthy for the recent market volatility.

Growth is slowing, prices are deflating, geopolitical turmoil is elevated, and Ebola is spreading.

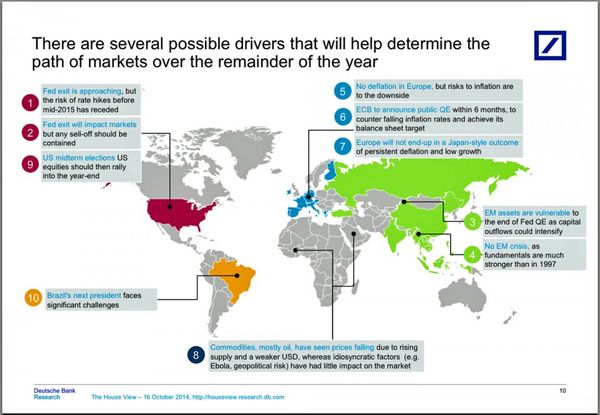

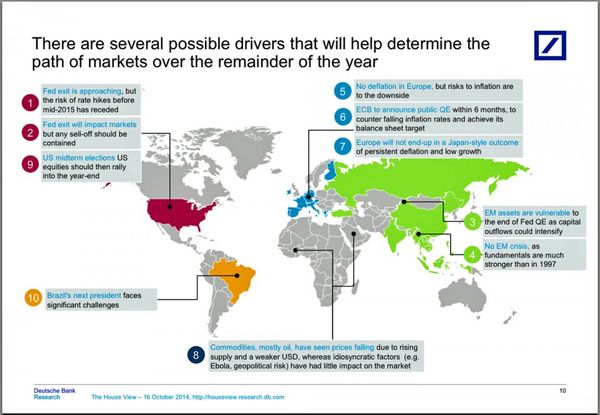

Deutsche Bank highlighted 10 forces that could move markets between now and the end of the year.

We live in interesting times.

The S&P 500 Index finally bounced.

Technicians sighed in relief as the S&P 500 had an oversold bounce near its April low support level. On a side note, Wednesday's price plunge marked a 62% retracement of the February-September rally.

The fact that the S&P 500 closed so far off its Wednesday low (in very heavy trading) also has the look of a potential "climax" bottom.

That's the good news.

The bad news is that the two day bounce on Thursday and Friday came on declining volume. In addition, the S&P 500 remains below its August low and 200-day moving average.

From a different perspective, there are many risks blame-worthy for the recent market volatility.

Growth is slowing, prices are deflating, geopolitical turmoil is elevated, and Ebola is spreading.

Deutsche Bank highlighted 10 forces that could move markets between now and the end of the year.

We live in interesting times.

The virus on your computer is NOT Ebola.

Here are some of the posts that caught my eye. Hope you find something interesting.

The virus on your computer is NOT Ebola.

Here are some of the posts that caught my eye. Hope you find something interesting.