|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Thoughts about the markets, automated trading algorithms, artificial intelligence, and lots of other stuff

I love books … bookshelf after bookshelf confirms that (I’ve even read most of them!)

So far, however, none of the books on those shelves were written by me.

Not surprisingly, it’s a lot easier to read one than write one.

The Internet makes being a bestseller seem easy, and writing the book even easier. It feels like everyone and their mother has a book.

But it’s not that easy.

After reading several posts on writing books, listening to experts, talking with friends that have written them, I’ve tried a lot of different approaches. I’ve transcribed speeches and presentations, I’ve chronicled dozens of stories on key points, etc. I've used book writing software, voice transcription services, grammar checkers, and even text expansion software, trying to make it easier.

I've spent more time not writing a book than many successful authors spent from start to finish.

Technology makes most things easier and faster … but, whether we’re talking about writing a book or a trading algorithm, at some point, you realize that it’s not enough to use tools, you also have to know how to use them.

If you don’t have the right skills and knowledge, tools only help you create garbage faster.

That is where Tucker Max and Book in a Box come in … When it's time to write your book, they can help.

Tucker Max has written 4 Best Sellers (for himself) with 3 on the Best Sellers’ List at the same time.

Here is an interview I did with Tucker about the book-writing process, and why it can be hard, even for very smart people, to write a book.

via YouTube

Are you planning on writing a book?

I am!

Here are some of the posts that caught my eye recently. Hope you find something interesting.

I just read that they sell more adult diapers than baby diapers in Japan.

Getting old is tough, and it gets tougher the older you get. As a result, finding your 'reasons for being' and joy in life becomes even more important.

Many people (all over the world) struggle to get up in the morning.

There's a Japanese concept called Ikigai that may help.

Finding your "reason to be" and living with purpose is a key to making the most of your time.

The graphic highlights something interesting (yet almost counter-intuitive) … When two areas intersect, it creates a something positive (e.g., a passion or a mission). However, where three areas intersect, it creates a pain point (for example it could be what you're good at, you love doing it, the world needs it … but it doesn't make you any money – so now you're struggling).

Worth examining and thinking about for a bit.

On a related note, here is a TEDx talk about the 9 common diet and lifestyle habits that help people live past 100.

TED-ED via YouTube

Live long and Prosper!

Sometimes it is nice to be reminded that great works are often performed by perseverance rather than strength.

via BrainyQuote

Here are some of the posts that caught my eye recently. Hope you find something interesting.

5 Ways Blockchain is Changing the Face of Innovation of 2018. (Forbes)

Singularity's Top 50 Breakthrough Tech Predictions. (Diamandis)

Don't Be Fooled: Russia Attacked U.S. Troops in Syria. (Bloomberg)

Not the End of the World: The Return of Dubai's Ultimate Folly. (TheGuardian)

The Price Per Square Inch of Pizza at 8 Major US Pizza Chains. (Visual)

It's Getting Harder to Tell Banks from Tech Companies. (Bloomberg)

In Praise of Elon Musk. (NationalReview)

No End in Sight for Amazon's Wild Ride. (Wall Street Journal)

Apple Sold More Watches Than Rolex, Swatch, and the Rest of the Swiss Watch Industry Combined. (Insider)

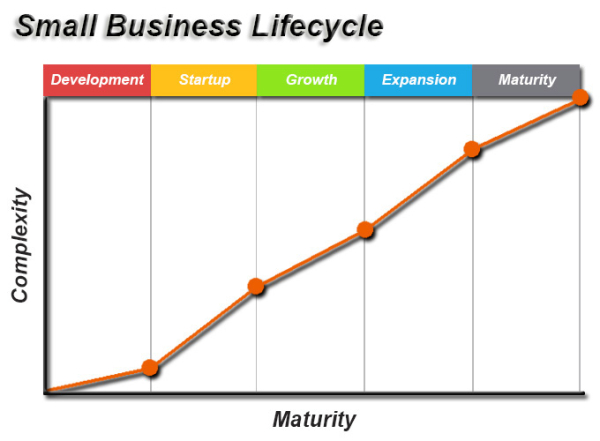

Growing a company is in many ways similar to raising a child.

In parenting, you watch your child crawl, walk, and then run. You also watch them go through phases, tackle new problems, and come out the other side of their trials a changed (and hopefully) stronger person.

In growing a company, you watch the idea take form (and evolve), and you watch a plan and path unfold. You also watch your team grow and mature as they encounter problems and strategy pivots that (hopefully) result in a stronger company.

In my opinion, persistence despite discomfort is a master key to success. In other words, learn to be comfortable being uncomfortable.

Breakthroughs happen in response to challenge.

The only companies that don't have problems are the ones that no longer exist. The goal is to hope for better quality problems.

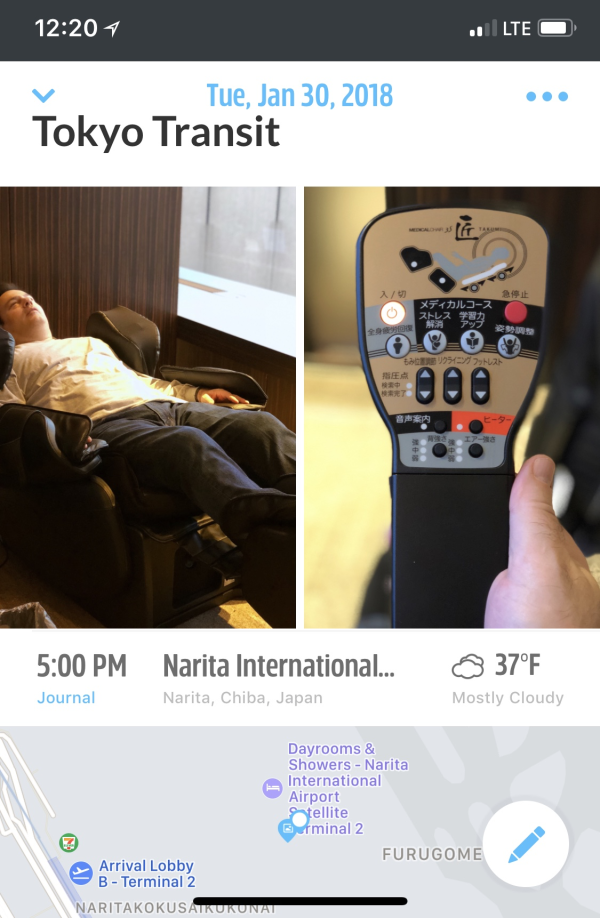

Even though my company specializes in automating things that people used to do, I have to admit that I was a little disappointed when I found out Japan Airlines no longer offers massages in their First Class Lounge. Instead, they have replaced the people with massage chairs.

I fly through Japan several times a year – and I had come to look forward to the quick massage between flights. I’d rush from the plane to the club to make sure that I got on the list (and would feel slighted if there wasn’t enough buffer time between flights to accommodate this indulgence). So, I was somewhat skeptical about the switch to massage chairs.

The reason was history – I bought my first massage chair in the mid-1990s … and it was not very good. Things have come a long way.

Here is a picture of me overcoming my reservations about technology (yet again).

It presses, stretches, rolls … and (most importantly) works. I was relaxed, refreshed, and tempted to press the button to do it again.

Sure, I didn’t understand the remote. But, I didn’t understand the massage attendant either.

On a related note, the club has robot toilets as well. What I mean is that a “washlet” guidance and targeting system automatically cleans the mess you made. Disconcerting the first time you use it … but, I want one.

Imagine the testing and QA process to get that right. Glad all we have to do is engineer trading systems to make and keep money.

Here are some of the posts that caught my eye recently. Hope you find something interesting.