We're about to usher in a new year – along with its promise and pressure.

We get a fresh start. We look forward to what we will achieve – but history says we rarely achieve everything we hope (it is also true that we rarely achieve things we don’t hope for).

So, dream big dreams!

Personally, I’m excited about 2019. Despite the volatile market and uncertain political climate, Capitalogix has spent almost 20 years preparing for where we are today.

Regardless of the outcome, we are doing things that seemed like science fiction even a few years ago.

I commissioned this image to remind our team to keep shooting higher.

Resilience, resourcefulness, and a worthy goal are the keys to many entrepreneurial success stories.

In the spirit of New Year's Resolutions – I’ll add that a deliberate approach to goals is important too.

Commit to your bigger, directional compass, goals.

Once you know what your long-term goal is, it is relatively easy to plan out the steps you need to achieve that goal. Achieving smaller goals reinforces success, builds momentum, and makes continued progress feel more likely.

Extra points if you make them SMARTs (Specific, Measurable, Attainable, Realistic, and Time-Sensitive).

It's not "I want to lose weight this year" it's "I want to exercise at least three times a week and track my calories daily so I lose at least 1 pound each month."

Actions speak louder than words, and your words can distract you.

If your goal is to win first place at a competition, focus on the metrics of a first-place finish instead of the medal. This makes the goal concrete and sets an internal locus of control on your victory. This also means that you don't need to tell others your goal too soon. Studies show that when you announce your intention to a goal in public, you decrease the likelihood of you succeeding.

Ask yourself:

Are the people around you the right people? Are you putting your money where your mouth is? Are you taking ownership of your actions, even when you can find excuses not to?

It's okay to misstep, it's okay to get stuck – but recognize what you've done and move forward.

Often the most frustrating thing that any of us feel on a regular basis is to want something really bad, and not be able to get it right away.

It's getting so that it's increasingly rare to find people who are truly willing to put in the requisite time necessary to get the traits or items they want. Our world today is trying to teach us that we must get what we want immediately; that it's our right. And that's why so many of us are jealous, smoke or drink, are overweight, use drugs, etc. …

Life is NOT like school.

In school, you can trick yourself into thinking you're doing great if you cram for exams and get decent scores. It is possible to get fairly good grades for a while that way.

But you don't learn it. You're likely to just remember it until the exam is over… maybe.

In school, you can fool the system and yourself. In the rest of the world, success leaves clues (and an imprint on you and your behavior patterns).

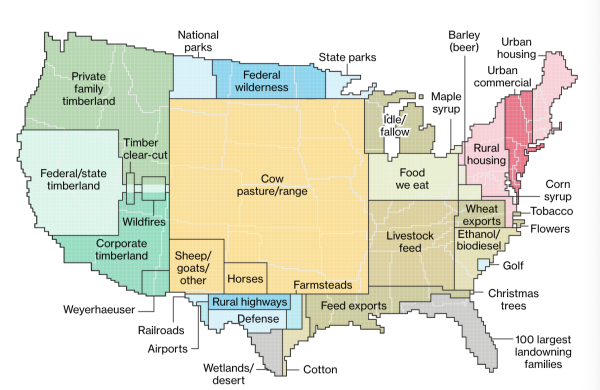

Real life is like a farm.

On the farm, you must choose what to plant. Then, you must move the rocks, buy the seeds, till the soil, plant the seeds, buy and maintain the equipment, pull weeds, keep the pests away, water the crops, fertilize, etc. And, for the most part, it’s not one and done … you need to keep up with what’s needed every day!

Follow the plan, and with some luck, you’ll harvest a decent crop at the end of the season.

Life is like this, too. You can't "cram" in life.

Don't be fooled. Overnight successes often take a lot longer than you’d think to gestate.

Luck often takes a lot work.

Put the effort in today and you'll get luckier and luckier. Will it be immediate? Probably not. Beat this into your head… Anything truly worth having is worth the time, the effort, and the sacrifice you need to invest in order to get it.

My grandkids one day will look back and say "Wow, our grandpa sure was in the right place at the right time." And to a certain degree, they're right … but it took a lot of work to be this lucky.

It's also important (once you've accomplished your goal) to set new goals. Capitalogix has a 20-year plan from today, and that's because I never got comfortable with what we'd accomplished.

If you're standing still, you're moving backward.

Here's to a successful 2019 and an even more successful 2040.

Onwards!