Over the past few weeks, we’ve discussed the threats and opportunities in AI. We’ve also recently taken a look at the themes that drove markets in 2025.

To summarize:

- AI and data infrastructure were big winners in 2025. So were precious metals and emerging markets. Meanwhile, REITS, non-AI software, and oil & gas underperformed.

- AI is still an incredible opportunity, but adoption won’t give you a sustainable competitive advantage; that comes from using it better in focused and methodical ways.

- One of the key themes/challenges of the coming years is something I call “The Future of Work”. We have important thinking to do about better understanding AI, what it enables, and where humans fit in this changing equation.

The Same Picture From a Different Perspective

Visual Capitalist recently released two charts that I thought were interesting. The first looks at global GDP growth. The second examines the top global risks for the coming year across various domains.

In the context of our recent discussions, I think they add value.

Beyond surface-level data, they also help explain how fear and excitement affect sentiment.

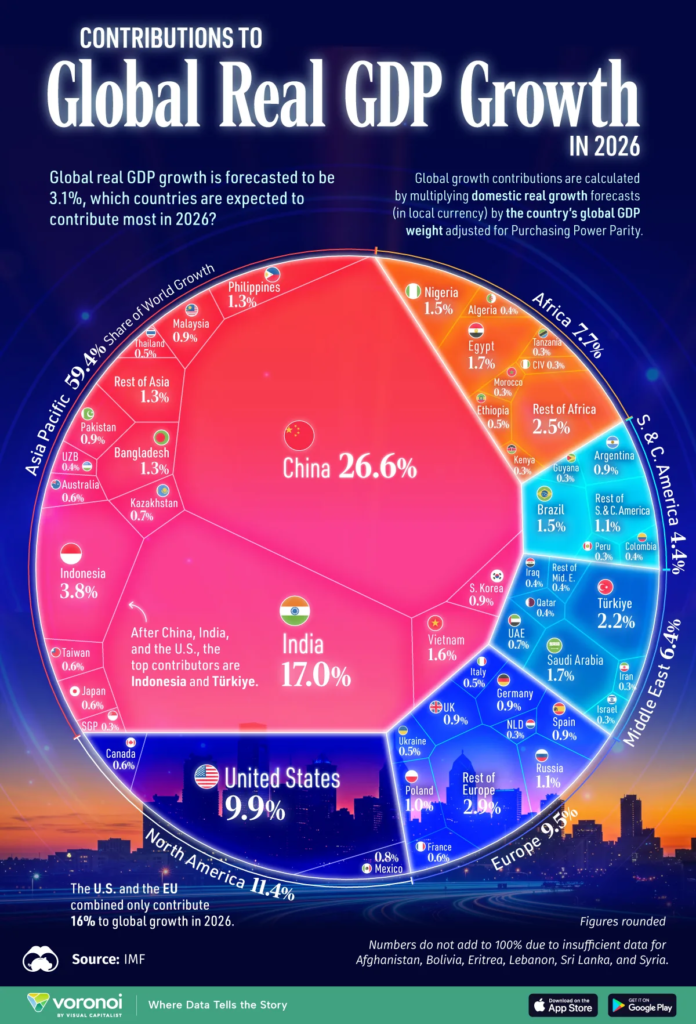

Who’s Powering Economic Growth in 2026?

via visualcapitalist

Global GDP growth is expected to be around 3% in 2026. A net positive. The infographic tells an interesting story as some of the larger economies slow and emerging markets grow.

In fact, the U.S. and the EU account for less than 20% of expected growth. Meanwhile, the Asia-Pacific Region accounts for about 60% of the predicted growth, driven primarily by China and India.

Both countries are incredibly populous and industrious, so their roles are unsurprising. However, the implications and second- and third-order effects of this might be surprising if the trends continue.

Overall, the growth in 2026 is expected to be driven by emerging markets, supported by population and workforce growth, as well as rising consumption.

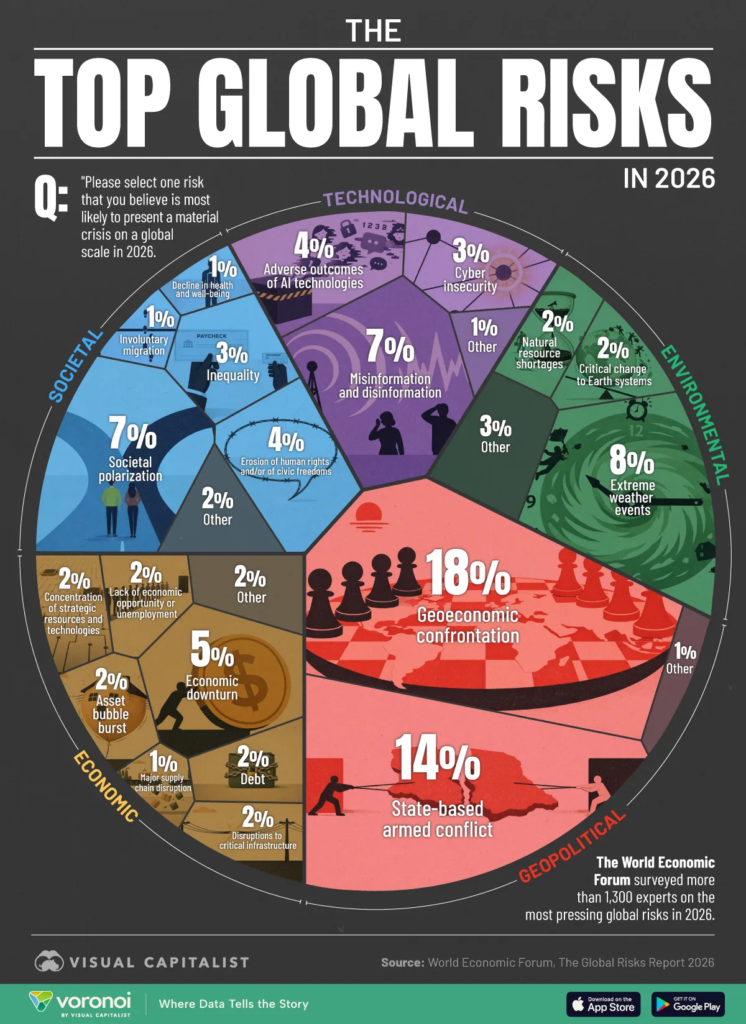

Expected Stumbling Blocks to Growth

via visualcapitalist

The infographic depicts sentiment data collected by the World Economic Forum through interviews with over 1,300 experts.

It doesn’t take much to realize the world is a powder keg of geopolitical and economic conflict. It’s undoubtedly been an underlying theme for many of our insights.

In 2026, geoeconomic confrontation is the top global risk, driven by multiple factors, primarily the tenuous transatlantic alliances and competition between the U.S. and China.

We live in a fascinating era. In addition to wars and the rapid growth of AI, we face increased polarization and misinformation. Meanwhile, environmental changes are evident through resource shortages and more severe weather events.

Choosing Cautious Optimism

It’s easy, looking at all of this together, to feel pulled in two directions at once.

On one hand, the risks are real and increasingly interconnected. Some of the factors include: geopolitical tension, economic fragmentation, intentional misinformation, climate pressure, and a technology that’s moving faster than most institutions (or people) can comfortably absorb. That’s not noise. That’s signal.

On the other hand, growth persists. Innovation continues. New regions, new populations, and new ideas are doing what they’ve always done: stepping into the gaps left by older systems.

The center of gravity is shifting, not collapsing.

This is where cautious optimism earns its place.

History suggests that humanity rarely solves problems cleanly or quickly, but it does tend to solve them eventually … not through a single breakthrough or perfect plan, but through adaptation. You might even call it evolution.

AI fits squarely into that pattern. It’s neither salvation nor doom. It’s leverage. And like all leverage, its impact depends on who uses it, how deliberately, and to what end. The real challenge ahead isn’t whether the technology works (because it already does) but whether humans can understand it well enough to integrate it responsibly into economic systems, organizations, and daily life.

We’re entering a period where progress and instability coexist. That argues for selectivity over speed, yet curiosity over fear.

I’m not calling for blind optimism or to deny the challenges in front of us. But the opportunities are real, and they reward a willingness to think in longer arcs instead of short cycles.

Onwards!

Leave a Reply