I enjoy looking at great disruptive companies and great examples of industries that are primed for disruption.

Think about how many companies have failed due to myopia… Radioshack couldn't understand a future where shopping was done online and Kodak didn't think digital cameras would replace good ol' film. Blockbuster couldn't foresee a future where people would want movies in their mailboxes, because "part of the joy is seeing all your options!" They didn't even make it long enough to see "Netflix and Chill" become a thing.

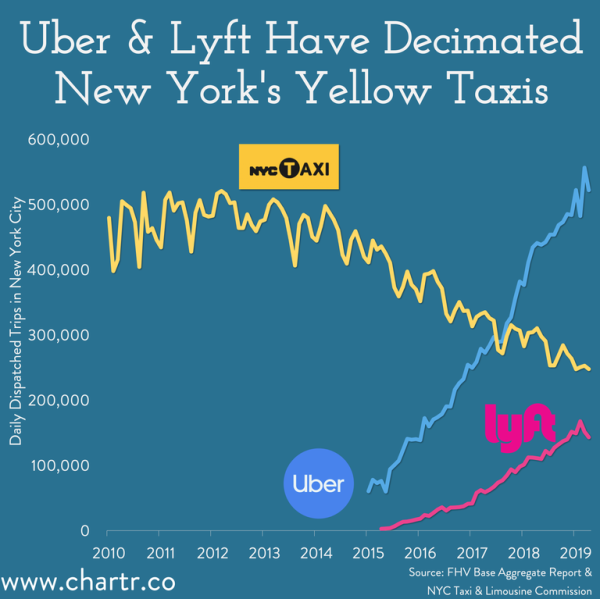

The Taxi industry had been ready for disruption way before Uber came along, yet, Uber may have mismanaged their opportunity. Taxis now have a chance to innovate back.

To run a taxi in New York you need a medallion. There are approximately 13.5 thousand medallions in NYC. In 2013, prices peaked at over 1.3 million dollars for a single medallion.

The medallion system has been broken for a long time. NYC taxis, in particular, were corrupt and the prices of medallions were artificially inflated by Bloomberg and de Blasio, and built on a debt bubble.

Taxis offered mediocre service, high rates due to artificial caps/greed, and often didn't take credit cards.

They didn't adapt and got disrupted. It's an age-old tale. The same tale as Blockbuster or Kodak; companies thinking linearly in an age of exponential change.

Taxi agencies had the infrastructure to edge ridesharing out and adopt friendlier policies but were slow to adopt the apps and convenience that modeled ridesharing.

via chartr

It's clear that there's an increased demand for rides. Increased demand is likely caused by access in places that didn't previously have enough demand for a full taxi-service. Ridesharing means you can have drivers in small towns, rural areas, etc. Almost all the new demand is being monopolized by ridesharing.

Should it be, though?

Leave a Reply